A data-driven look at fintech adoption in vertical software

09/2024 update: the full data set behind this post is now available at https://www.verticalsoftware.fyi

The two trends I’m most bullish on are vertical software and embedded fintech.

Businesses of all sizes rely heavily on software increasingly built for a specific vertical. Within verticals, businesses increasingly prefer the convenience of integrated, all-in-one suites over multiple disconnected vendors. These software suites have started embedding financial products to provide more value, monetize at a higher rate, and increase customer retention.

“Vertical software + embedded fintech” is a well-known strategy (I call it “vertical ERP”). Although there are plenty of market maps and Top-10 lists for vertical software and embedded fintech individually, I’ve never seen a data-driven study of how vertical SaaS companies adopt embedded fintech, so here it is. Thank you to Amit Kallakuri for his great help gathering and refining the data.

Defining vertical software and financial products

We started by gathering a list of several hundred vertical software companies.

What “counted” as vertical software? We included companies that focused on explicit verticals (versus horizontal markets) AND whose product suite was, or at least aspired to be, multi-product (versus point solutions).

One way to consider qualifying companies is to look at the chart below. Companies in the green area were included. Companies in the yellow were sometimes included (judgment call), and companies in the red were typically excluded.

Practically, the companies in the green had websites that looked like the ones below, with wording like “Everything you need to run your {{business type}}” or “The operating system for {{vertical}}. For example:

Their navigation often had a product dropdown that included a mix of vertical-specific software products (scheduling, CRM, marketing tools, etc.) and financial products. For example:

We reviewed this list of vertical companies and tagged financial products: payments, lending, banking, cards, expenses, accounting, taxes, payroll, and insurance.

We tagged a company as having a product only if offered in an integrated or embedded way. For example, a deep and robust Quickbooks integration didn’t count as accounting, whereas a natively integrated P&L, cash flow statement, etc. within the product itself did. Most cases were clear, but some judgment was required in others.

We also categorized each company into ten verticals: restaurants / retail, construction, real estate, logistics / supply chain, education, government / non-profit, professional / field services, hospitality / travel, beauty / wellness / fitness, and healthcare.

That gave us a database that looked like this:

An updated version of this data set has been published at:

https://www.verticalsoftware.fyi

We then analyzed the data to learn how vertical software companies adopt financial products. An important disclaimer: this data is directionally correct but not perfect. We didn’t cover every vertical SaaS company, and we did our best to assess which products they offered and what vertical they were in.

Here’s what we learned.

How is fintech adopted in vertical software?

Companies had a median of 1 financial product and a mean of 1.9 products.

I was surprised that 11% of companies offered no financial products. I expected some companies to offer none, but 1 out of 10 seemed high, given these were generally successful and scaled vertical software companies, and embedded fintech has been a known strategy for several years.

The number of companies offering only one product also surprised me. I thought the median would be around two or three. More on this below.

83% of companies offered embedded payments, but no other financial product surpassed 25% adoption.

This wasn’t surprising, as embedded payments acceptance, pioneered by Stripe and now improved on by companies like Rainforest, is a well-known strategy in vertical software. Payments is a great way for vertical companies to monetize customers beyond SaaS. All businesses must accept payments, and few love their existing payment provider. Bringing that into software enables powerful follow-on use cases like lending and accounting.

However, it was surprising that no other fintech product broke 25% in adoption. Expenses came close at 23% but still far from payments.

42% of companies offered only payments.

This shouldn’t be too surprising. However, it also helps recast the chart above on the mean and median number of products adopted. If payments are the most logical product to start with, then maybe the payment-only companies are still early in their embedded journey.

If payments are the logical starting point, then it also makes sense that the overwhelming majority of companies with two or more fintech products have payments as one of those products.

The most common product pairs were “payments + expenses,” “payments + accounting,” and “payments + payroll.”

I was surprised at the relatively low coincidence of otherwise seemingly complementary products, like cards and expenses or accounting and taxes.

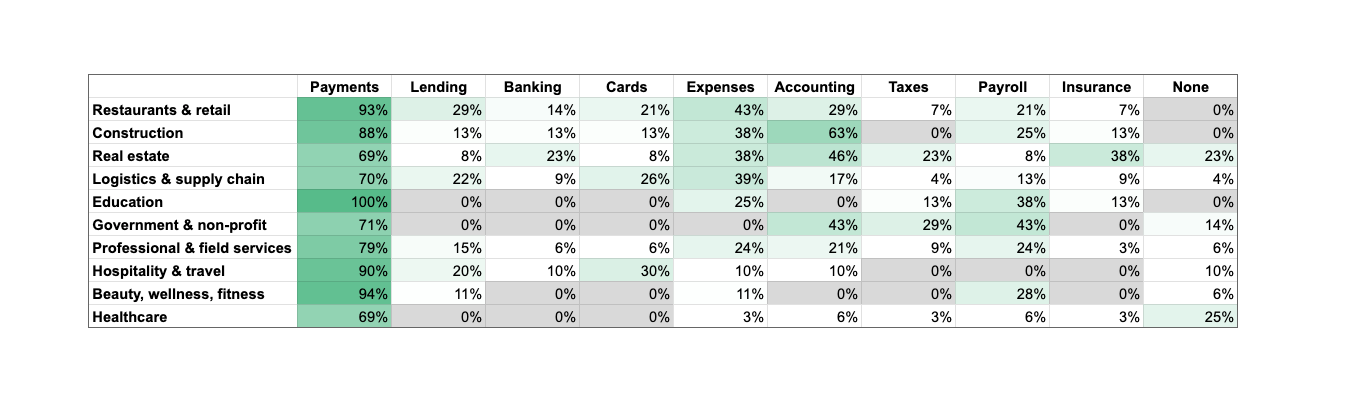

We found up to 3x differences in average product adoption across verticals.

I was surprised by the size of these differences and the industries that were furthest apart. The industries I expected to adopt less tech had higher average embedded fintech adoption (e.g., construction and logistics). The ones I thought would have above-average adoption had average or lower fintech adoption (e.g., professional services and hospitality).

Non-payments product adoption varied significantly (4-10x+) across verticals.

The presence of variation across verticals shouldn’t be surprising, but the size of the variations surprised me. For example, more than 60% of construction companies offered embedded/integrated accounting, while 0% of the education, beauty, wellness, and fitness companies did.

While there’s still room to expand the adoption of all products in all verticals, this highlights the importance of knowing a vertical deeply before building or investing in it. Even if you’re convinced that a certain vertical needs a certain product, there are many nuances to building one product in one vertical versus another.

Takeaways for founders and investors

The right level of resolution for takeaways is not in the specific numbers (e.g., 20% lending adoption in hospitality versus 29% in restaurants and retail) but in the major differences between products and verticals. Here are my takeaways:

Payments is the beachhead of vertical software’s fintech strategy.

Every business needs payments. Handling payments also give the software vendor access to critical data and downstream workflows, including the ability to fund banking, card, and payroll products, underwrite lending products, and populate products like accounting and taxes.

Non-payments adoption (lending, banking, etc.) is still in its infancy. Nearly every company we looked at uses nearly every financial product described here, although most do so directly rather than through the software vendor—for now.

For example, none of the verticals had >50% adoption of embedded payroll, although ~100% of the companies use some payroll solution. This is more a question of time and right to win/embed than anything else. More on this below.

When you compare verticals, there’s significant variance in which financial products are adopted.

If you’re building for a vertical, don’t blindly copy the embedded strategy of another vertical. Think about your specific vertical needs. Similarly, if you’re building an embedded fintech solution, carefully pick your vertical ICP(s). For example, it may be easier to sell embedded lending to professional and field services (15% adoption) than healthcare (0% adoption).

When you see low adoption of a product in a vertical, consider whether the product isn’t suited for the vertical or there’s an opportunity for growth.

Low adoption of a given product in a particular vertical isn’t good or bad. Most companies in all verticals use most of the fintech products listed, but not in an embedded form yet.

So the important question is: How much of that is addressable via embedding, and over how much time? How you approach the problem will determine how you look at it. If you’re a vertical software company, you must understand the maximum embeddability of the different products (such as in the construction below on the left). If you’re an embedded fintech founder, you must understand the embeddability of your product across multiple verticals (such as on the right).

Payments adoption shows that a significant attachment rate is possible. While not every embedded product may reach those rates, the real attainable rate is likely higher than what’s shown in the data. The founders who win in each market will be the ones who figure out the real attainable rate for any product or vertical (the white boxes above) and pursue it.

Conclusion

This data makes me even more excited to invest in vertical software and embedded fintech. It shows how early verticals are in adopting and combining embedded fintech. It underscores the importance of going vertical-first in understanding a customer’s needs rather than blindly applying strategies from other verticals.

Between the rapidly growing demand for software from businesses and the swell of vertical software and embedded fintech companies supporting them, this remains a very exciting area to build and invest in. As always, if you’re working on something interesting in this area (or just thinking about it), I’d love to chat with you: mb @ matrix.vc