How to index an entire business model

TLDR

Changes in technology lead to new business models (e.g., browser → SaaS → AWS → freemium).

This cycle is moving faster and enabling many novel spins on business models, such as consumer ecommerce subscriptions, usage-based pricing, and hardware-as-a-service.

These new business models represent new and complex ways of creating, measuring, and capturing value, and so require a purpose-built stack to manage the workflows and payments for the new models.

I call this stack “specialized billing systems” and think they present a huge opportunity to “index” the entire business model. That is, they can potentially monetize every company on that business model.

The principle applies not only to how companies get paid, but also to how they utilize and pay for labor and services. Remote work and the creator economy are some recent areas where huge “specialized payout systems” are being built.

Technology and business models evolve together. Technology opens new opportunities in what can be monetized as well as how it can be monetized. The faster technology changes, the faster business models evolve to keep up. This both requires and propels further technological changes, continuing the cycle.

Software is a major catalyst here, but it's not the only one. Advances up and down the tech stack -- from logistics to payments to batteries and beyond -- spawn new business models faster than ever before.

Consumers and businesses benefit from increasingly diverse ways of using goods and services. Now commonplace models like software-as-a-service (SaaS) and transactional e-commerce are giving way to emerging ones like consumer-goods-as-a-subscription, usage-based pricing, hardware-as-a-service, and more.

The power of the index

Elad Gil wrote about “index companies”, which “take a cut of every transaction in their space, or are a piece of infrastructure everyone in the market needs [... and are a way] to participate in the market broadly without having to worry about who wins in it.” He defines indexes of specific markets: Coinbase indexes the crypto market, NVIDIA the AI market, etc.

But there’s a more compelling version of an index company: one that indexes an entire business model. I call companies that do this specialized billing systems (SBS).

The technology shifts that enable new business models also require entirely new ways of measuring, delivering, and monetizing value. It's often insufficient to cobble together existing tools for that, hence the need for SBS.

For example, the shift from licensed software to SaaS required not only recurring billing, but more self-service options, a more direct relationship between billing status and product/feature availability, multiple billing configurations (monthly vs annual billing, multi seat, add ons, etc). These are all complex to support and novel to the SaaS model.

SBS like Zuora, Chargebee, and Recurly arose to handle that complexity. These SBS grow proportionally with their underlying SaaS customers. They benefit from the widespread adoption of the SaaS model without being overly tied to a specific application of it.

SBS are such a big opportunity because they can index many markets at once. For example, the emerging hardware-as-a-service model can apply to B2B robotics and heavy machinery, mobility (e.g., ebikes), consumer hardware and appliances, and much more. These characteristics of indexing and multi-market gives SBS companies a massive TAM.

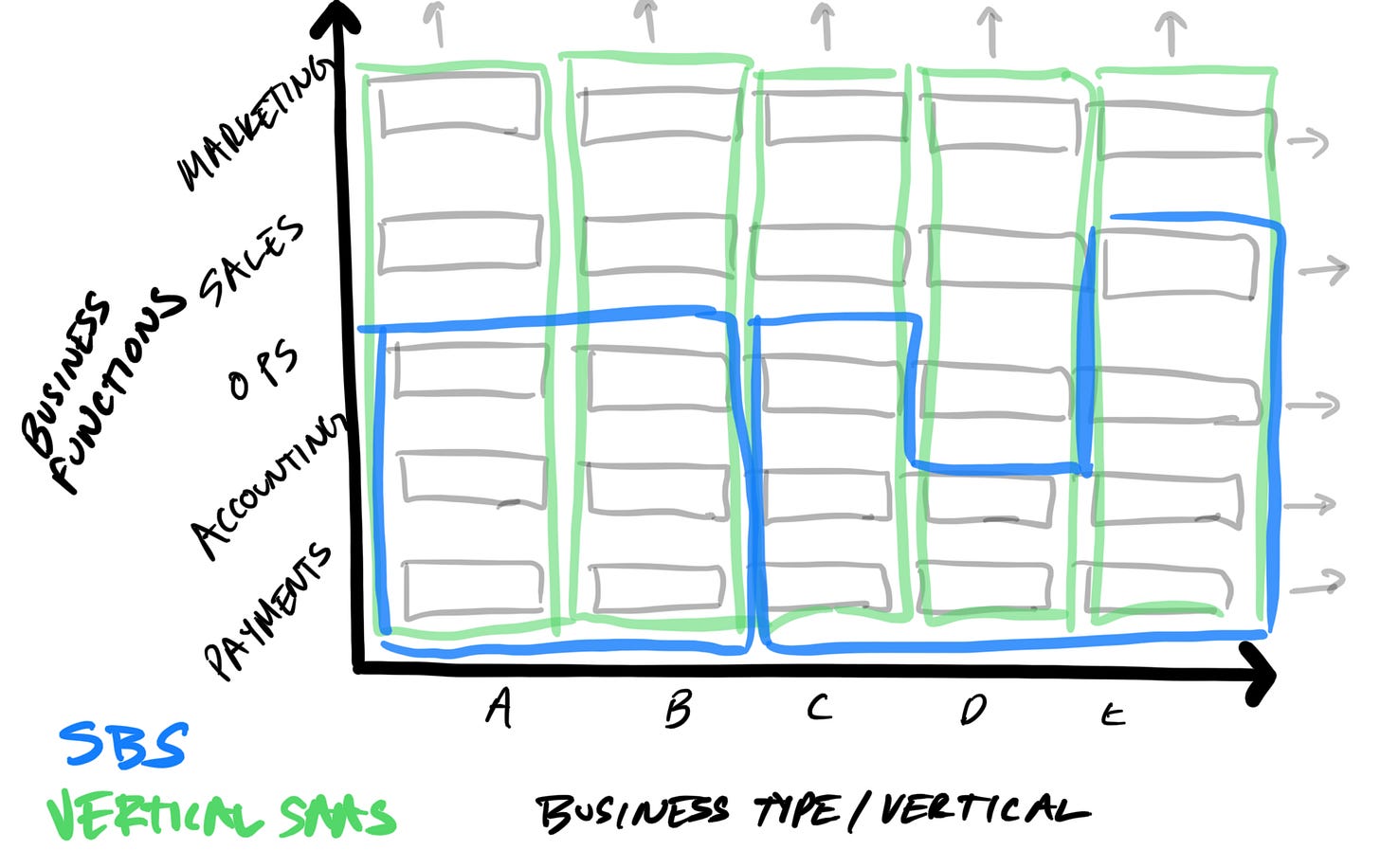

Finally, SBS are distant cousins of vertical SaaS or VERP companies[1], but have fundamental differences. While both can act as an index and aim to combine software and financial products, SaaS and VERP aim to own the entire stack of an industry or product type, while SBS are more horizontal products that touch workflows closer to payments across multiple industries:

Introducing specialized billing systems

Specialized billing systems (SBS) help companies with novel business models manage their workflows and payments, which are complex because of the characteristics of that business model.

The workflow is as important, if not more important, than the payment component. It's straightforward to build software to "charge customer X the amount of $Y on date Z,” but it’s much more complex to determine how much to charge, for what, and when, and orchestrate the actual delivery of the product or service in certain business models. For example, consumer subscription companies like Dollar Shave Club not only need to charge their customers monthly for their subscription, but handle a long tail of scenarios and edge cases specific to subscription ecommerce companies: managing product add ons, splitting or skipping or changing shipments, handling renewals, and more.

To understand the power of SBS, it helps to contrast traditional business models with newer ones. Most businesses have straightforward models or value chains – depending on which business school-y term you prefer. This is a generalization, but a company with a traditional model sells products or services on a one-off, transactional basis for a predetermined price.

This model applies to businesses as large as Tesla or United Airlines, and to those as small as the neighborhood grocery store or dog walker. There are plenty of large incumbents and challengers supporting this transactional business model space because it is so large and mature[2].

However, there is much more opportunity to index novel business models, since they are disruptive and not served well by incumbents. The size of an SBS opportunity is proportional to how much the new business model deviates from the traditional one-off, transactional, and fixed price model.

Let's go through some examples of SBS, starting with more mature examples, which will help set the context, and then onto more emerging SBS opportunities as well as opportunities in payouts.

Opportunities in specialized billing

SBS companies can be built for any business model that deviates from the traditional, one-time, fixed fee transaction. That is, opportunities exist wherever the transaction deviates from “I give you $X, you give me a product or service, and our transaction is complete”. And the greater the deviation, the greater the opportunity. Below are some examples.

Recurring subscriptions

This is now a mature business model without the complexities of the newer one, but it’s worth discussing as a baseline.

Subscriptions are a well-known model for consumers and, in the last few decades, for businesses, with the advent of software as a service (SaaS). Let’s focus on SaaS, although there are plenty of old school consumer subscription products as well (e.g., newspapers and magazines).

It can seem simple to bill for a SaaS product. The user chooses a plan where the price is known upfront, and then is charged that price every month until they cancel.

It seems simple, but as anyone who has tried to build this themselves before can attest, it can get complex quickly. How do you handle changing plans, particularly mid billing cycle when there is a price difference? Or introducing new plans and versioning old ones? What happens if a customer’s payment fails, and does that differ based on the plan they’re on or their payment method? What about discounts or annual plans? How do you handle what features are available to different plans?

And that’s not even getting into the complex adjacencies of collecting the proper taxes, ensuring all the revenue is recognized and reconciled properly, etc. All that complexity for just offering users the option to pay $10 or $20 per month!

The SaaS model is now over two decades old, so this is a competitive category filled with players like Zoura, Chargebee, Recurly, etc. Even Stripe is getting into the game with Stripe Billing, following the sage advice to “commoditize your complement.”

Ecommerce / CPG subscriptions

Ecommerce provides a great example of the need for SBS, as it juxtaposes a simpler transactional model with an emerging subscription model.

Most ecommerce stores still rely on the simple transactional model: a customer visits a Shopify store, adds an item to their cart, enters their payment details, and the item is shipped to them. It’s not much different than walking into a store, buying an item, and walking out. It’s a one-time transaction for a set amount.[3]

However, as consumers get more comfortable with ecommerce, it's also getting more expensive for merchants to acquire them. Many merchants are both realizing the growing cost of acquiring consumers who never come back, and seeing the growing popularity of digital consumer subscriptions like Amazon Prime, Netflix, etc.

This has led many ecommerce brands to recognize the power of the subscription. Whether it’s household items like toothpaste and toilet paper or air filters, or consumables like vitamins or smoothies or coffee to clothing.

It’s an obvious win for merchants since it increases LTV, as well as consumers since it’s more convenient, saves them money, and reduces the overhead of replenishing such items.

But it turns out there’s an incredible amount of complexity in running a physical subscription service. Consumers may be able to swap out individual items in the order, which affects pricing, taxes, inventory, and shipping date. Consumers may want to change their delivery date or skip a subscription. This just scratches the surface of the in-the-weeds problems that these merchants face. So it’s clearly much more complex than just “charge $X every month on the consumer’s shipping date unless they cancel.”

To handle this, an SBS must integrate with a variety of complex, specialized, and adjacent systems, starting with the ecommerce platforms themselves like Shopify, but also including inventory management, shipping and logistics and returns, customer support tools, and more.

One company in this space, Skio, does a great job of representing this complexity in their feature list. It may seem overwhelming or overkill, but the page shows they have solved the many edge cases that CPG subscription companies and their customers care about:

Usage-based pricing

Usage-based companies charge based on (you guessed it) usage: i.e., some mix of what product/service was used, how much was used, and occasionally other factors like when it was used.

This model has existed for a while, particularly in utilities like water, gas, electricity as well as phone and data plans. However, significant changes in technology and buyer behavior are giving the model new life, particularly in API-first software companies.

Twilio is one of the OG API-first companies and a great example of the complexity inherent in such a model. They have multiple products, each of which has different prices that are often measured in fractions of a cent, and which change based on the pricing tier as well as the billing method (e.g., pay-as-you-go, volume discounts, and committed volume discounts). These prices also vary based on the country you’re transacting within.

Many usage-based companies combine some aspects of the SaaS model (i.e., a recurring monthly payment for a minimum usage or quota), with more usage-based pricing, such as a base monthly fee for a minimum use and then tiered pricing beyond that minimum.

Further complicating this is the option to use a “stored value” or “credit” model. In the stored value model, the company requires a customer to pay ahead of time and then depletes credit as the service is used (e.g., Twilio’s entry level plans). In the credit model, the company allows a customer to use the service and then pay for whatever they used at the end of the billing period. Some companies mix these models based on the customer and product.

In addition to that complexity, different usage-based companies have different underlying costs and so want to treat things like billing failures differently. For example, Twilio must pay carriers for each SMS and thus incurs a real cost for its usage, so it’s likely to be more stringent on overages and payment failures. This contrasts with a company like Maxmind that can be more flexible because it’s simply selling access to a mostly static database, where their costs are mostly fixed in assembling the data rather than variable by individual usage.

Usage-based SBS must integrate with a variety of internal data sources and third party products for things like account provisioning, analytics, metering and throttling, and reporting both internally and to the end user. SBS also enable proper financial reporting and reconciliation, which its variable nature and mix of stored value and credit models make immensely complex.

Examples of companies in this space are Kable and Metronome.

Hardware-as-a-service

The hardware-as-a-service (HaaS) model allows expensive assets to be rented (generally <12 months) or leased (>12 months) to businesses and consumers. You can think of the opportunities as split between B2B and B2B and then on a gradient from less to more expensive:

HaaS is an significant evolution from the “dumb” equipment financing model that has existed for decades. This evolution brings additional complexity that makes it another great example of the need for SBS.

Let’s take expensive B2B hardware as an example, such as Markforged in 3D printing or Vecna Robotics in robotics (or “robotics-as-a-service” / RaaS). In addition to renting or leasing the core hardware, these providers bundle multiple other products and services with the asset. For example, they may package a maintenance or repair plan, or offer a subscription to different levels of proprietary software to use alongside the hardware. For assets like 3D printers that involve some kind of consumable print media ( filament, resins, powders, etc), the HaaS provider can track usage and replenish these on a subscription or just-in-time basis.

So a successful HaaS company must deploy and monetize multiple products at once, from the hardware itself to software to services to material inputs for the hardware. This requires the coordination of various systems, from inventory and shipping to diagnostics and servicing to financing. The need to orchestrate these various systems, which are likely only used in this configuration in service of this business model, again highlights the need and opportunity for SBS in this space.

The other side of the coin: specialized payout systems

The way businesses make money is changing, but so is the way they spend it. These changes aren’t as obvious from the outside of a company as a business model is, but they’re no less significant an opportunity to index an entire shift in spending because of the complexity inherent in it.

Spending on labor is a powerful example, since it’s often a company’s largest cost. The traditional model has been to employ people full time in a local office and pay them a fixed monthly salary as W2 employees. But now companies are shifting spend to an array of non-W2 options, from independent contractors, agencies who in turn use their own sub-contractors, international full time employees, and more.

These new labor options emerged from technological innovation, just like the new business models. Technologies like Zoom, Slack, Figma and more made in person work less critical for many roles. So, the addressable talent pool is no longer “whoever is willing to live within commuting distance of the office”—it’s “whoever can work with us in whatever configuration makes sense for that job.”

These new arrangements require new workflow and payment tools. Deel, which provides compliant payroll for international contractors, is an excellent example of this. Before Deel, there were significant and complex hurdles to hiring internationally; not least of which were how to actually employ people in a way that’s legal in your country and theirs, and how to make payments to those different countries and currencies. It was just too expensive and time-consuming for most companies to entertain.

Deel solved all that. They wrapped compliant and legal hiring documents for 100+ countries with a robust employer-of-record model and seamless international payouts into a single, easy-to-use product. Most powerfully, because Deel made something so easy that was previously too complex, they massively expanded the market for international labor. As in the SBS examples, the actual payment within Deel is necessary but not sufficient to the business’s power. It’s the combination of easy international payouts with a specialized version of legal and HR software to compliantly hire that was the big unlock.

The creator economy is another example of a new labor segment that requires its own bespoke workflow and payments tools. Stir, which provides creators with a “financial studio for collaborating, splitting revenue, money management and metrics,” exemplifies the opportunity. Because creators are a mix of independent contractors, gig workers, and media companies themselves, how they are paid for their work gets interesting and complex very fast. This complexity only increases as creators team up with each other for individual products and monetize their content across multiple platforms.

Stir plugs into platforms like Youtube and Spotify to help split revenue among various creators on a per-project or per-content basis. Like the examples above, the actual money movement, creation of 1099s, etc is critical but not sufficient for such a product. That is just the output of this bespoke workflow of deciding what should be paid out to whom and when.

There are other big opportunities hiding in plain sight. Just look for places where a large number of businesses regularly pay out large sums of money that do not flow through the standard W2 payroll system or the invoice-based procurement process.

Closing thoughts

Although SBS will do best initially by building sticky and reliable workflows and payments, there’s more opportunity in adjacent services.

Many of these SBS lend themselves to bootstrapping two-sided networks. For example, a CPG subscription company could offer consumers a way to see and manage all their subscriptions across merchants, and thus become a destination for such purchases. This is similar to what Afterpay did with its shop directory and Shopify with its Shop app.

The SBS also lends itself to offering other financial products like credit or issuing to one or both sides of a transaction. For example, a usage-based billing or CPG subscription company may be able to better underwrite and offer revenue-based financing to its customers because its data is even further upstream of cash flow. SBS for expensive assets — such as heavy machinery and fleets — could offer financing to customers to help close sales. Conversely, a payouts-centric model like Deel already offers recipient cards and early payout options that allow them to monetize both sides of a transaction.

SBS are exciting because they are the natural, second order effect of the rapid evolution of new business models. They require a deep understanding of that evolving business model and the variety of adjacent systems, practices, and payer and payee expectations. If you’re building something in this space, I’d love to chat about it with you. mb@matrixpartners.com

[1] Note that SBS share some similarities with vertical ERPs or vertical SaaS, but are different in meaningful ways. Whereas vertical SaaS and VERPs focus on specific business verticals, specialized billing systems focus on specific business models. A vertical is defined by the type of product or service a business provides and who they provide it to, and a business model by how that product or service is distributed and paid for. I.e., business verticals answer “what” and “who”, and business models answer “how”. Business models can cut across verticals. For example, usage-based pricing can be found everywhere from utilities like gas and electricity to EV charging to many developer infrastructure products like AWS, Twilio, and Scale

[2] There are multiple multi-billion-dollar companies that serve specific parts of this transactional model, from the payroll providers (ADP, etc) to the constellation of horizontal and vertical AP companies (Netsuite, Bill.com, Melio, Wex, Fleetcor, Shopify, etc). These are generally competitive markets because the transactional model is more mature.

[3] You could argue that transactional ecommerce itself is a mature SBS, since the buyer and seller aren’t co-located. So the ecommerce store must check inventory, calculate shipping and taxes, facilitate shipping and tracking, handle returns, etc in addition to actually charging the buyer a set amount.