The iron triangle of embedded fintech

The next big fintechs will win with novel distribution, not novel products.

In the 2010s the biggest fintechs were product innovators. They closed the gap between the poor UX of traditional financial institutions and the great UX of digital-first products. They combined new tech, regulatory frameworks, and business models to create genuinely novel products: Chime’s branchless bank, Robinhood’s fun fee-free trading, innovative consumer credit products like Earnin’s earned-wage-access or Afterpay’s buy-now-pay-later.

With that gap closed, the edge is now in distribution. That doesn’t mean product innovation is unimportant. It’s just a necessary rather than sufficient condition.

The great distribution edge will be found in embedded fintech: the distribution of financial products through non-financial companies. It’s no longer about building novel products and bringing users to them, but bringing products to where users already are. Think Toast offering payment processing to its restaurants, Uber offering financing to its drivers, etc. Payments and issuing are just the beginning. Every financial product, from payroll to insurance to mortgages and beyond, will be embedded.

Embedded fintech is so powerful because it’s so positive-sum if done right. Each player in this complex value chain ends up better off. Taking the example of banking-as-a-service provider Unit, which provides deposit accounts, payments, and lending to businesses through platforms like the SMB invoicing tool Invoice2go:

The embedded infra partner (Pacific West Bank, in the example above) gets access to incremental, long tail demand without a proportional increase in costs to acquire or service that demand. Depending on the vertical, these partners can be sponsor banks, issuers or acquirers, insurance carriers, capital providers, etc.

The embedded infra provider (Unit) also gets access to incremental customers through platforms.

The platform (Invoice2go) gets to increase monetization, retention, and satisfaction with its end users without having to develop these financial products from scratch.

The end user (Invoice2go’s customers) gets more convenient and financial products within a product they already regularly use.

The end users’ customers (if applicable) find it easier to transact with the end user (e.g., if a business offers integrated online payments versus requiring a less convenient offline option)

The details of this value chain vary with each specific financial product. However, the key takeaway is that embedded infra providers connect untapped or inefficiently matched supplies of financial products (left side of the chart) with demand that’s pooled in platforms (right side).

Even if “embedded fintech” is the obvious and positive sum trend, it’s not obvious how to execute it. The challenge is not just technical or regulatory, but primarily one of incentives.

Embedding fintech means making hard tradeoffs

2010 fintechs succeeded when they combined new tech, reg, and biz model elements into a cohesive and novel whole. 2020s fintechs will succeed if they can align a set of fragmented and complex incentives up and down the value chain.

These conflicting incentives are clearest when viewed through the lens of a platform that’s deciding whether to embed financial products for their end users. The platform’s incentives are a good lens because they’re literally in the middle of the value chain. They share some incentives with the embedded fintech provider above them and their users below them, and with their infra provider’s partners and users’ customers by extension.

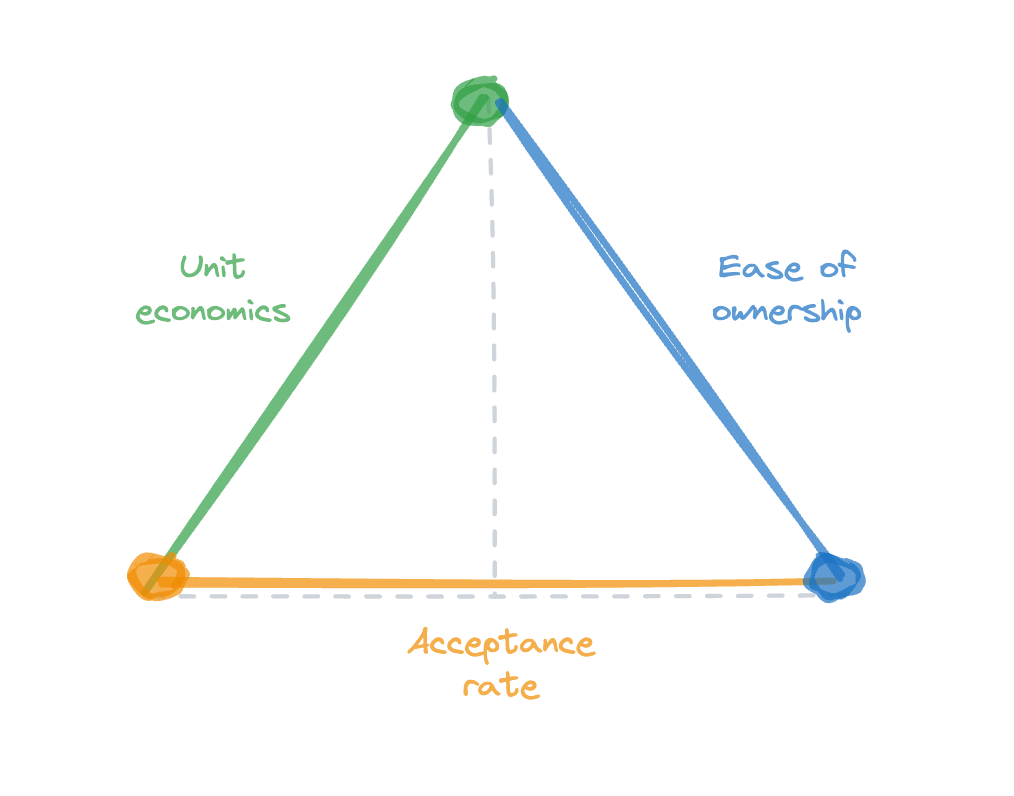

Platforms must make trade offs between three factors when choosing an embedded fintech provider:

Ease of ownership — Is it easy for the platform to implement and maintain the embedded fintech product? How much of the technical and regulatory burden do this have to bear? What kind of specialized functionalities (like risk, compliance) do they need to staff up?

Good unit economics — How will the embedded product change the platform’s unit economics? This is more than the upside of revenue share, but the potential downside of credit and fraud losses. How is that shared across the value chain?

High acceptance rate — This is a non-obvious one to many platforms who haven’t launched financial products before with credit, fraud, and regulatory risk. If a platform will promote a product, they want it to be available and accessible to a good portion of their users.

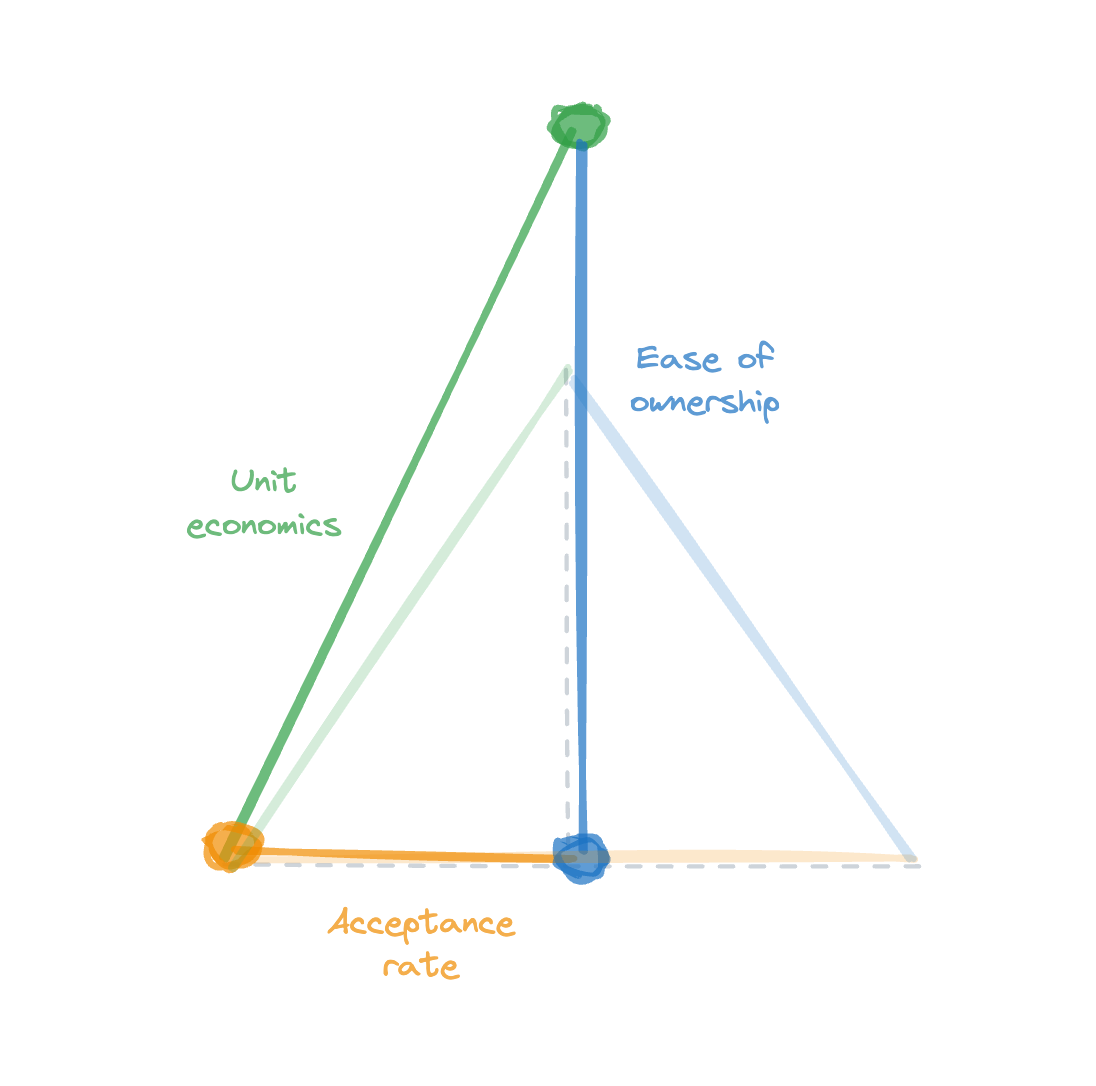

These factors are in tension with one another. You can’t change one without it affecting the others. This is what I call the “iron triangle of embedded fintech”: you can only optimize two factors at most at a time, and improving one necessarily degrades a third.

An embedded product that has low cost of ownership and good unit economics likely achieves that by cherry picking the lowest risk and highest profit users and rejecting the rest, leading to a low acceptance rate and thus a poor UX for a platform’s end users.

A product with a low cost of ownership and a high acceptance rate likely focuses on onboarding quantity over quality users, leading to losses and poor unit economics over time.

A product that has a high acceptance rate and good unit economics likely requires significant upfront work and ongoing optimization by the platform to make the financial product available to many users but also avoid losses, leading to a high cost of ownership.

How embedded fintechs can use this model to win

This framework offers several lessons for embedded fintechs.

First, recognize that you can’t optimize for all three factors at once and understand which shape best fits the largest market segment at a given time. Some of the earliest embedded fintech providers started with a “low cost of ownership, low unit economics, high acceptance rate” approach as a strategy to win adoption among companies. Stripe comes to mind, making it very easy to get started but not offering the economics of a more DIY approach.

Second, aim to build an embedded product that supports multiple triangles under a single architecture and thus serve multiple market segments at once. Stripe has done this well with their Connect product. It comes in three flavors – Standard, Express, and Custom.

Their docs have a great chart comparing these three different implementations, with the tradeoffs falling into one of the three factors described above:

Their pricing page does an even better job of explaining the benefits and tradeoffs of each model: Standard is fast and easy, Express is also easy but with more control over the economics, and Custom is expensive to own but gives greater flexibility and economics:

Third, figure out how to escape the iron triangle constraint and optimize for all three at once. Product innovation will play a big role here. For example, an embedded fintech could offer better risk tooling that allows platforms to increase acceptance rate without a proportional increase in losses and harm to unit economics. Or the embedded fintech could invest in better SDKs, components, and software tools that decrease the cost of ownership.

AI could play a powerful, under-the-radar enabling role here. “Ease of ownership” is a constraint because in “high cost of ownership” situations the platform can require substantial headcount in engineering, support, risk, compliance, etc to manage the product. However, AI that can make things like custom implementations or compliant, platform-specific support easier can increase the ease of ownership without harming the other factors.

Similarly, “high acceptance rate” is constrained by the need and ability to control risk. Today companies typically do this by throwing headcount at the problem, but this is also an area where AI could augment or even replace headcount, allowing for more and better risk coverage.

Conclusion

Just because something is obvious doesn’t mean it’s easy. The opportunity of embedded fintech is obvious, but nailing the right set of tradeoffs at the right time isn’t easy.

The most successful embedded fintechs will understand how their ideal customers think about these tradeoffs and make the necessary and subtle adjustments to their products, go-to-market, and pricing. Hopefully this model is helpful in making those tradeoffs obvious and in setting winning strategies for the next big wave in fintech.

Have feedback? Working on something interesting in fintech or thinking about it? I’d love to hear from you. mb at matrix.vc