A chat with Michel Rbeiz, Toast's GM of Fintech

On Toast's product and fintech strategy, how AI complements full stack products, trends in embedded fintech, and more

I recently chatted with Michel Rbeiz, Toast’s GM of Fintech. Toast was an early pioneer of today’s biggest trends, from vertical SaaS and integrated payments to embedded fintech. Michel plays a critical role in Toast’s growth and has a front row seat to the trends shaping fintech and vertical SaaS. There are tons of insights here for anyone building, operating, or investing in this space. Enjoy!

Matt: Let’s start with you introducing yourself and talking about how you ended up at Toast.

Michel: I'm an immigrant. I grew up in Beirut. I went to school there, then came to the US to study electrical engineering and computer science at MIT. I started my career at McKinsey, and then started a couple of companies in the consumer and fintech world. Those were great experiences, but ultimately like a lot of start-up stories they didn’t pan out.

I then went to work at State Street, one of the oldest and largest banks in the US. I had a variety of roles, but the common thread was turning the business into a platform. Then towards the end of 2022 I started talking with the Toast team to join and lead the fintech organization. After meeting much of the team and founders in the interview process, it was just clear that it was a great fit. I always admired what they had built and I believed I could make a difference at this stage of growth.

Matt: Awesome. And before we go deeper, can you give the elevator pitch on Toast?

Michel: The simplest way to think about Toast is as a cloud-based, all-in-one digital platform for restaurants. Fundamentally Toast helps restaurants run better, grow their brand, and manage their teams and back office. We started with the point-of-sale (POS) that helped restaurants take payments.

“I like to think of Toast as concentric circles starting with the POS, and over time, we added ways where we can actually help our customers really grow and thrive.”

Over time that’s expanded to not just in-person, but also digital channels. We’ve expanded into nearly every area of running a restaurant including guest-facing surfaces - for example we help restaurants attract guests, make reservations, and manage guest relationships and loyalty.

We also help power the back of the house: everything from products for managing your team, like scheduling and payroll, to investment management, access to capital, and more. I like to think of Toast as concentric circles starting with the POS, and over time, we added ways where we can actually help our customers really grow and thrive.

Matt: Great. So tell me about your current role and Toast and what you focus on?

Michel: I’m part of the product organization at Toast. We have a GM structure, and I’m the GM of fintech. Fintech means different things to different people, but for Toast it’s four things.

First, it’s the payments engine that helps our merchants take all sorts of payments.

Second, it’s lending and embedded finance. We have a fast growing lending platform, and we’re starting to embed other financial products as well. Think providing access to bank accounts and the like to our customers.

Third, we have team management. That’s primarily scheduling and payroll and team management.

And fourth, suppliers and accounting. That's helping customers with things like accounts payable automation, balancing their books, getting insights from their COGS, paying their suppliers, managing inventory, etc.

Matt: That’s very clear. It’s a great way of thinking about all the things you can do when you focus on a specific vertical like restaurants. It seems like Toast has been very intentional about expanding those circles over time. What was that journey like expanding from point of sale? How do you start layering on additional products, deciding what to focus on?

Michel: Let me go back in history. This will be a little bit of a guide to how Toast makes decisions. Toast actually didn’t start as a POS company. It started as a mobile payments company. The founders realized this was really hard to turn into a successful business, so they went back and talked to their customers. They quickly recognized common needs around POS specifically, with opportunity for reinvention there.

“[Toast’s founders] made 3 decisions early on that were incredibly consequential – but at the time these weren’t well understood or accepted things.”

At the time, tablets were still a relatively new thing. So a cloud-based tablet solution made a ton of sense. And this thread of “where do your customers need the most help?” is how they went from mobile payments to where we are today.

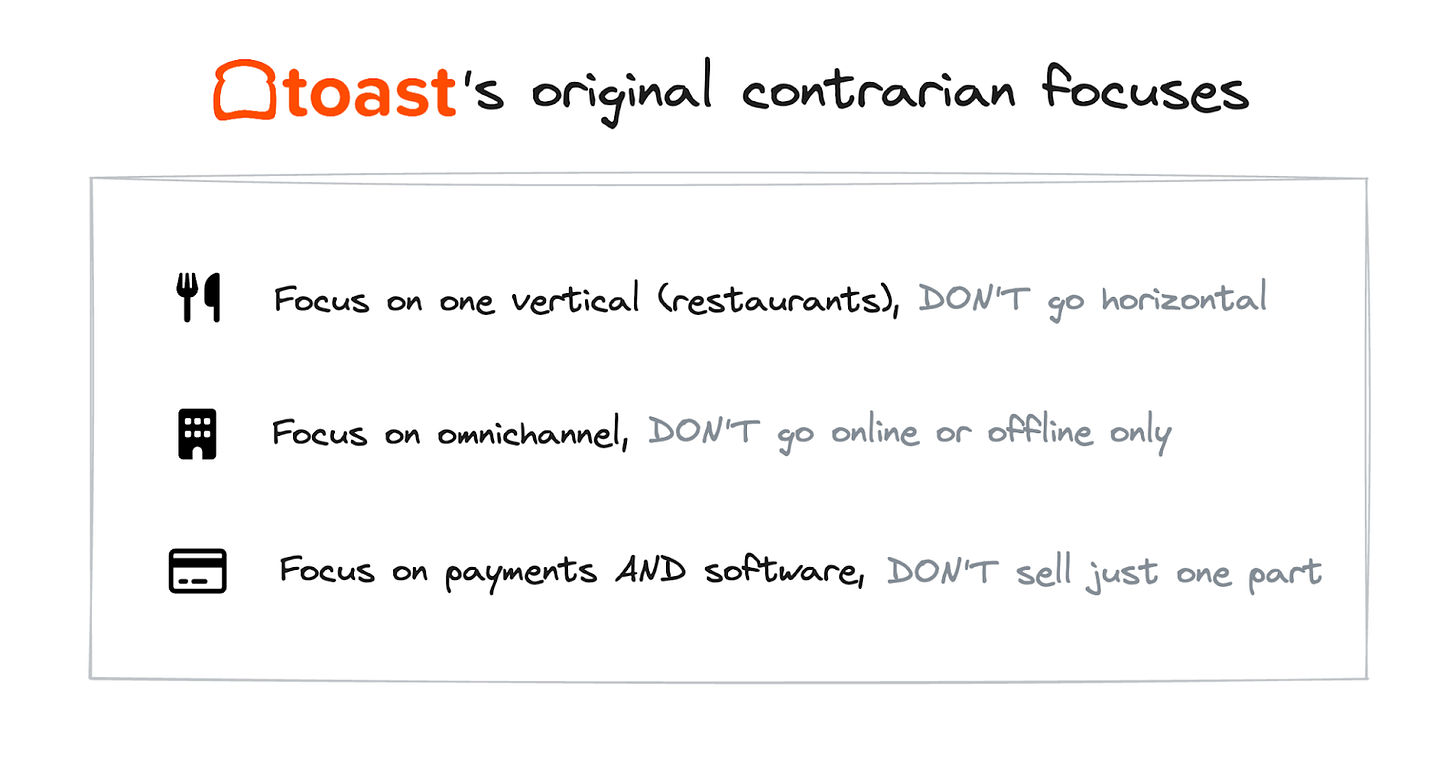

They made 3 decisions early on that were incredibly consequential – but at the time these weren’t well understood or accepted things.

First, they focused on restaurants. This was unique because at the time the generally accepted knowledge was that the future was horizontal solutions. You had the McKinseys and BCGs always talking about horizontal solutions. Toast made a very explicit decision to be very vertically integrated, which was not common at the time. Now everyone talks about the benefits of being vertically integrated.

Second, they had a direct, on-the-ground, differentiated go-to-market function. This was the belief that brick and mortar and omnichannel were key. It went against the generally accepted wisdom at the time that everything was moving online.

The third thing was a business model decision: requiring payments as a part of every deal with restaurants. This enabled both SaaS and payments monetization. Now that’s a more accepted strategy, but at the time many people thought SaaS fees were enough to build a big enough business.

Those three decisions were customer-led and instrumental to where we are today. The rest of it is really as simple as talking to customers and listening when they say “Oh gee, I wish you could help me with this.”

Matt: It's funny how the default or accepted strategy changes so much over time. Going back to the first insight of focusing on restaurants… it’s still a big category. There are many different kinds. Single location, multi-location, QSR versus sit down, different geographies, etc.. How do you think about prioritizing where you start pushing out those concentric circles?

Michel: It's a really good question. At Toast we're very customer-led, in the sense that we listen a lot to our customers, identify what their pain points are. Now the customers aren’t very good at telling you exactly what they want, but they'll guide you. They’ll say, “This is a big problem area.”

The second question we ask ourselves is, “Can we build a 10x product?” Do we really have a differentiator? For pretty much every problem our customers deal with, there is a solution out there. But can we build a 10x solution? Do we have an advantage?

For example, one big thing just because we're talking about fintech, is risk-based products. We have unique vantage points because of the data on our platform. We actually know our customers very well, probably better than anyone else.

The third is, is this a big source of value for our customers first? If we help them solve this, does it really make our customers more successful? Then maybe fourth is, and maybe this is related to the 10x-ing, do we have a right to win?

We could bet it's a big problem. It's valuable for our customers. We think we can 10x it. And by the way, do we have a right to win in that market? And then at the end, you put some numbers together and you say, “How much effort is it going to take? What is the outcome both for our customers and for ourselves?” And that's roughly speaking how we think about it.

Matt: That's a great way to go about it. Obviously the bundling approach, the concentric circles, is a powerful one for you and your customers if done well. But it can go wrong if you say, we have this captive audience, but we're going to bundling a bunch of products and force them on the customers, and they're going to take it because they're buying the suite from us, and it doesn't need to be as competitive as point solutions, for example.

So how do you think about keeping the quality bar high on your products within that bundle while having that MVP mentality? And how does leveraging your existing, risk-based advantages that you have as you sit on top of all the business data factor in? You have this very captive audience who have, I would imagine, a great affinity for Toast, but you also want to continue to grow your product in this area over time.

Michel: It's a really good question. People will say, “You have this captive audience,” but there are a few things that get missed in this thinking.

The first thing is: how much value can you deliver to a customer and how much will they ultimately pay you? You can put a number on it, let’s say in the tens of thousands of dollars. As noted on our last earnings call, it was on average around $12,000 for Toast. Let's say you could increase the ARPU a lot more than that in some cases, but generally that’s the zone. On average, we're not going to make $300,000 from one customer. By definition, there are constraints of the business.

I always like to compare it to a store with limited shelf space. I say this because the customer's attention span or their patience with Toast as we try to do more is limited. You can’t pitch them 20 things. You can pitch them a handful of things. So what are the handful of things? What we then do from a product development and commercialization perspective, we're fairly disciplined about it from an alpha, beta, and then what we GA as a product.

That's what we really test for. There's the four or five things I went through: Do we have 10x the value prop? Is it valuable for our customers? Do we think we have a right to win? And does it also work for us as well?

“I always like to compare it to a store with limited shelf space. I say this because the customer's attention span or their patience with Toast as we try to do more is limited. You can’t pitch them 20 things. You can pitch them a handful of things. So what are the handful of things?”

We're pretty quick at iterating through this. For example, we’re piloting a high-yield bank account product for customers. We built it in about 7 or 8 weeks. At the end of the pilot, if we think it hits all the metrics, we'll decide to GA it, or we may just say this is not actually going to work.

Matt: That's very helpful. That leads to the next question, which is when you have this portfolio of products, obviously, point of sale and payments is the core of your concentric circles. How do you think about the value or the job to be done to you as the platform? One of them or a handful of them is the initial hook that brings the customer in. Other ones are more about stickiness. Other ones are more about revenue and expansion. Do they all have that kind of objective? Or how do you think about the jobs to be done of your products and the product portfolio when there are so many in there?

Michel: We've recently reorganized our products. We have way too many SKUs for our customers to handle separately. So we reorganized how we think about our products in suites. We have 6 suites right now.

The first one is the POS and restaurant operations. Second is digital storefront, basically in person versus digital. Third is marketing, and the job to be done is how do you market and attract your guests. Fourth is payroll, hire, onboard, and pay your employees. Fifth is manage your team. Sixth is manage your suppliers and accounting. What's not on there as well is some of our embedded finance products, which gets me then to our go-to-market motion. And there are a couple of things that are in the works.

We have three motions when approaching our customers. The first one is a land motion, the initial sale. What happens next depends on which segment the customers fits in: are they full service over $2,000,000 of annual sales? Are they a small diner, QSR, a coffee shop? The packages that we optimize for every sale are a little bit different.

The second motion is the expand motion, which means they’re onboarded onto Toast, they're happy with our products, so what are the follow-ons that we can go in with and help them.

The third motion is a product-led motion. When I think about embedded finance, a lot of what we do in embedded finance is mostly product-led at this point.

Those are the three motions. We try to optimize everything because you can't sell everything to everyone. We spent a lot of time thinking about that go-to-market motion and how to optimize each one of the land, expand or product-led growth.

Matt: That makes sense. Talking about these embedded products, it brings me back to something you mentioned before, which is the benefit of Toast sitting on top of all these different products that a business uses to run on. So how do you think about risk, how do you think about using that data? And maybe give some specific examples where that's been a competitive advantage for you in building new products. Specifically that overlap of risk and product and go to market, which is very unique in such a vertically integrated product like Toast.

Michel: Yeah it is. There's a couple of other things too. We haven't really captured the benefits of all of this, but let me give you some themes I think a lot about.

We talked about risk and understanding the risk, of understanding our customers and therefore being able to help price risk. I think that’s a massive advantage. It's not just a massive advantage because a particular customer processes payments on our platform, it's because there's a network of other customers that look and feel exactly like them. When we train our models, we're able to train them on a big cohort that is almost self-reinforcing because you're the only one that has this data.

Another theme I think a lot about is faster access to money. We know what the payments flow is. We know what the lending flow is. And increasingly we're going to know what the COGS are, what the payroll is. You don't have to squint very much to say that we’ll have line of sight into something like 70 or 80% of the cash flow of a restaurant.

How do you create a better product built for restaurants that combines all of those things? And it creates some real opportunities. You could do what banks do today. For example, if a bank knows money's coming into their systems, but the money has not yet settled, do they give their customers access to their money before the funds are good? Yes, they do, because it's in the system. They just haven't settled. And you could see very similar opportunities being created for Toast and across the entire ecosystem.

There's also a lot of talk around AI. A simple thing for us to consider is, how do you use AI to help a customer run their business? So right now, if you and I were to do it, we'd look at it in a very systematic way. But you could just train an AI on an entire cohort.

Just riffing here, as an example, but at some point it would basically suggest something like, “You have a pretty high balance of gift cards. And by the way, Wednesday is a slow day for you. Why don't you run a promotion to get those people who have gift cards and run some form of promotion, like 20% off? You have the capacity to serve them, and it just really works out for you.”

There's so much opportunity to really help operators just run better. And we haven't even talked about what we could do for the employees of those restaurants. Just think a little bit about everything that we do for restaurants, eventually maybe we could do for employees too.

Matt: There’s a lot there to talk about. On the AI discussion in particular, I'm curious how you think about that AI across the broader organization. Is it an enabling technology that will improve lending and will improve payroll and improve scheduling, and all these sorts of different things?

Is it more the foundation for a relatively new product or relatively new standalone product or this analysis layer, as you just mentioned? How do you think about where AI is most effective as an enabling technology for a multiproduct company like Toast?

Michel: Simplistically, I'll maybe use words like old AI versus new AI. There is the old AI, which is more machine learning, data science-driven. And we are very advanced users of that. That's what powers really our data science models to enable bank lending on our platform, so that we could predict defaults, business performance, powers a lot of our scheduling, etcetera.

And then there's the new AI. New AI is basically the era of ChatGPT. How do you use generative AI to then create some interfaces that frankly didn't exist before and ask it to do things that you couldn't do before? We don’t do this yet, but you could actually throw all the data that Toast gets out into Gen AI and say, “Hey, build me a P&L.”

There are some companies who do this. And so starting to explore some of those ideas, you could actually ask Gen AI, “Look at the data that Toast gets, and tell me how I can run the restaurant better?”

Matt: That makes sense. We talked about your different product areas. Each has some kind of financial product component either directly within it or adjacent to it and then some kind of software component as well. Those are typically two different worlds. Building software and building financial products. They're just two different mindsets in a lot of cases, two different ways of building and thinking about products.

And so what have you or what has Toast learned about building high-performing teams that combine these two different types of products across multiple different areas?

Michel: It's a good question, so let me try to break it down. And the core of it is that we focus on the problem to be solved, and we try to solve the problem in its entirety with one team. I say this because what we don't want is, for example, one team to solve the payment side of it and another the software side. You want one team to do both.

So there are some products that are solutions-oriented. They solve a very clear customer problem, and then there are products within Toast that are more platform-oriented. So let me just give you two examples of those. Our payments rails is a platform. It's a platform that basically powers our billing solution, our payments acceptance, our digital storefront, our POS, etc. So we think of it as a platform.

Whereas our lending product is a solution. It's all-in-one. It's like we solve a very clear customer problem, which is to provide them really quick access to a loan. And our value prop there is speed, a day or two roughly speaking. That's really what we try to do. And there’s the entire experience that we own end to end, including the entire stack.

And then it comes down to how you organize these. And very often within Toast, we organize them either as a triad – product, design, engineering – or a quad – commercial, product, design, engineering. One of those two models. It really depends how heavy the lift is on the commercial side.

Matt: You mention the commercial piece, and you talked about the MVP of bank accounts. Within say embedded fintech in particular, how do you think about the build versus buy versus partner trade-off there? There's obviously a lot in fintech that you can't do right away. On the other hand, again, Toast has been known to own a lot of the stack themselves very early on.

So how do you broadly think about that set of trade-offs within fintech where there's such a broad surface area and a lot of complexity underneath that surface?

Michel: It's a good question. On build versus buy, I don't think our framework is much different than most companies. It comes down to, is it absolutely core to the experience? Is it differentiating? And are there enough players in the market that we could source multiple proposals from? That's really what it comes down to. There's another overlay that is, does it actually matter?

Take a payfac example: when you're small, let's say you're processing a billion of GPV, 5 bps on a billion of GPV is half a million. Then you think a little bit. What is the team that I need to get that 5 bps down to 1 bps? It's going to cost a whole lot more than a million and then half a million. Five bps on a hundred billion is ten times that number. All of a sudden, putting a team, or for that matter two, on that makes a lot more sense.

So putting aside the core versus differentiating, there's always as well, is this actually worth our time? So, being a payfac makes a lot of sense for us at our level of scale. The other question we always get is, should you go direct? Well, what do you get by going direct? And how much do you save? And that's relative to the size of our business. And maybe the other thing that I'll think about that I'll mention as well, we always think a little bit about resiliency when it comes to partners.

Matt: That makes a lot of sense, particularly at the scale that Toast is today. If you have businesses beginning to rely on a lending product or any financial product, we're talking about storing, moving, or lending money, then resiliency matters.

Michel: Yeah. And when it comes to financial services, we think our differentiator is around the experience, as well as on the product definition. It's less on the ‘could we get funding’ question. We work with banks that actually do that. We are all about the experience, tailoring the products to the customers, and helping them deliver value and assess risk.

Matt: That makes sense. If you step back and think about either embedded fintech specifically or just fintech generally, what areas are you most excited about? What products do you see a lot of upside in, whether it's inside of Toast or outside of Toast?

Michel: I think we've talked about most of them. It comes down to how to connect the various experiences between all the different products that differentiate the product as a whole.

Right now, if you're a small business, the bank that you typically work with is not building a product specific for restaurants. The loans that you get are not built for restaurants. Right? So bringing that into one ecosystem together where you could literally say to someone, “I'll help you accept payments. I'll give you instant access to money. By the way, I'll lend to you based on that. I'll give you a credit card or a debit card for you to spend based on that. And by the way, I'll enable the people that work for you instant access to their wages.”

Getting that ecosystem right is super powerful. Once you do all that, you can potentially even tell them, “By the way, we have access to a lot of your data. I can actually help you run your business better.” That is really exciting. I think we're barely scratching the surface on what we could do for the hospitality industry.

Matt: You touched on what I think is one of the largest shifts over the last 10 years, that Toast has been a big driver and beneficiary of. If I'm a new restaurant owner 20 years ago, I go to my bank, and I say, can I get a small business loan? Here's the business plan. Can I get funding and a bank account and card processing and all these other services? But today, you start with Toast. I don't have to sit down and talk to someone. Everything I need from day 1 to expansion and beyond is all accessible within Toast.

“What's on the Toast platform is really the heartbeat of the business. Being able to help our customers run better, get more for their guests, is what's super powerful.”

Michel: The platform, by the way, can measure the heartbeat of the business. That's what's super powerful. The Apple Watch tracks so many things — it turns out one of the biggest benefits of having an Apple Watch is that it can alert you: “Hey! Something is not going right. You should go see a doctor right away.” Not to go all the way on the analogy here because I don't think a lot of it applies. But what's on the Toast platform is really the heartbeat of the business. Really being able to help customers run better, get more of their guests, is what's super powerful.

Matt: I love that heartbeat analogy. And just like, unless you had very specialized hardware in the past, it would have been difficult to track this easily, on an ongoing basis, so today you have this platform in Toast.

It's not just the payment, but it's the lending access. It's not just the lending. It's the scheduling. It's the, it's the full stack. Are your employees doing well? Is your top-of-funnel business doing well? How's your marketing? How's your cash? There's no, there's no more comprehensive view of a business's health in this vertical than I can imagine about that.

I think that’s a great note to end on and we’ve covered a lot of ground. Thanks again Michel for taking the time!

My name is Matt Brown. I’m a partner at Matrix, where I invest in and help early-stage fintech and vertical software startups. Matrix is an early-stage VC that leads pre-seed to Series As from an $800M fund across AI, developer tools and infra, fintech, B2B software, healthcare, and more. If you're building something interesting in fintech or vertical software, I'd love to chat: mb@matrix.vc

And if you’re a vertical software founder, operator, or investor, check out Vertex, The Vertical Software Conference in San Francisco on September 9, 2025.