The power of point-of-sale products

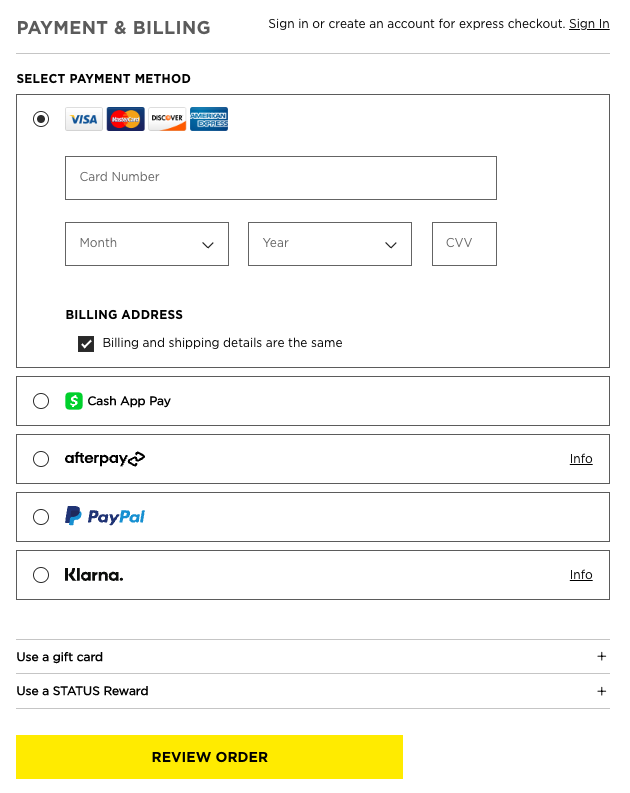

If you’ve bought anything online in the last two years, you’ve noticed the checkout page is… crowded. Gone are the days of simply paying by card. Instead, online shoppers now face a multitude of payment options and add-ons.

Buy-now-pay-later (BNPL) providers like Afterpay and Klarna are the most common. Still, there are plenty of other new options, from the incumbents’ BNPL offerings (Paypal, Amex, etc.) to new pay-now options (Apple Pay, Amazon Pay) to fast checkout options like Bolt or Shop Pay.

This crowding has become a meme, representing the heavy competition in the BNPL space. But under the meme, there’s an insight: point-of-sale (POS)¹ is a powerful place to distribute a product, and these BNPLs are an early wave of new and exciting products that will be distributed at POS.

What makes POS products so powerful?

It’s easy to underestimate POS products because we encounter them so often. However, they’re a compelling place to sit for several reasons:

(1) They provide effectively free marketing and distribution in a time when consumer-oriented fintechs live and die based on their CAC. Checkout is the one part of a site that every buyer is guaranteed to see. Even if they don’t use a particular POS product, consumers are exposed to it at every checkout. The merchant is effectively advertising the product to all of its customers. The merchant is thus lending its brand halo to the POS product, giving it an implicit stamp of approval and increasing consumer trust.

(2) They’re often highly aligned to the merchant’s business model. Most POS products have little to no fixed costs. They charge the merchant on a variable, as-used basis (e.g., payment processing or BNPL), or they don’t charge at all, and instead offer a revenue share (e.g., upselling insurance or warranties).

The lack of fixed costs and the alignment with revenue means that the barrier for most merchants to try a new POS product is so low. This low-or-no-fixed cost model is why reducing the merchant onboarding time and complexity for these products is so critical for their success.

There’s some opportunity cost: checkout real estate is more crowded, and crowding can decrease conversion. However, a simple-to-test POS product with a clear merchant value proposition is powerful. For example, it costs a merchant nothing to offer Afterpay at checkout; the merchant only pays a percentage of the order value when a consumer uses it. Because Afterpay increases the merchant’s average order value and checkout rate, the increase in sales outweighs the merchant fee.

(3) Most POS products can build a trusted consumer brand, allowing them to become a destination, directing future consumer demand, and giving them more leverage in merchant acquisition and pricing. If the POS product’s value is distinctive enough, consumers will prefer to buy from merchants that offer it, if not exclusively from them.

Take the example of card payments: fewer and fewer people carry cash, so cash-only stores lose business. However, card payments are so ubiquitous that most people don’t explicitly seek out stores that offer them—but some consumers certainly avoid stores that are “cash only”.

That preference cycle is accelerating with NFC payment methods like Apple Pay. Some people don’t carry physical cards anymore. Eventually merchants that only accept physical cards and exclude NFC will also lose out.

New POS products like BNPL have such a distinct value prop that consumers may start their purchasing journey with the BNPL brand and explicitly filter for merchants that offer it.

For example, Afterpay’s users loved the pay-it-in-four option so much that they’d start their shopping journey not at a specific store, but at Afterpay's shop directory. For example, rather than looking for a sweater at Store X, they would use Afterpay to search for stores that both sold sweaters AND accepted Afterpay. This ability to drive new customers to merchants was an incredibly powerful tool to acquire and retain merchants and defend margins.

The evolution of POS products

So, given that POS products are so powerful, where are the opportunities to build big businesses here? I think we’re at the end of the second phase of innovation—but an even larger and more exciting third wave is building.

The first wave was alternatives to card payments (1998-2016), mainly in the form of early digital wallets like Paypal². However, there was arguably as much innovation outside the US in this time, if not more. That was primarily in countries that leapfrogged card payments with super apps like AliPay and WeChat in China or novel systems like M-Pesa in Africa.

The second wave was mainly alternative credit products in the form of BNPL, which ate into the share of checkout and payment volume from card providers (2016-2022). This started around 2016 and is reaching maturity today. Shopify has been a significant enabler, both by building a checkout flow that supports third-party payment options like BNPL and by getting big enough that it became worthwhile to build businesses on the Shopify platform.

The third wave (2022+) is about moving beyond payment methods to upselling additional products and services at POS. There are only so many ways for a consumer to pay for a purchase (hence the current cutthroat competition on checkout pages). This competition drives innovation in the additional products or services offered at checkout.

Looking at these antecedents might help identify opportunities in this third wave. Below are some areas that are top of mind for me.

Opportunities in the next wave of POS products

We’re still in the early days of POS product innovation. BNPLs have shown the power of being at POS. Consumers are used to doing more than just entering their credit card at checkout. And platforms like Shopify have made it easy to add new products and experiences. That, plus the continued growth in ecommerce, means there will be a flourishing of new POS products. Many of these new opportunities don’t seek to replace payments (highly competitive and crowded) but offer additional products at the point of sale. Non-exhaustive list of interesting opportunities:

Insurance and extended warranties for products: This is pure incremental revenue to the merchant and increases the checkout rate by making the consumer feel comfortable making an expensive purchase (e.g., electronics). Example: Extend

Insurance for activities (weather, injury): This has the benefits above in incremental revenue and increased checkout rate, but applied to high-value activities and experiences such as theme parks, concerts, bike or ski tickets and rentals, etc. Example: Sensible, Spot.

Eco-friendly additions: As consumers become more environmentally conscious, they want to offset the effects of their purchases, such as by buying carbon credits or planting trees. These products may or not share revenue with the merchant, but they can increase conversion and provide a positive brand effect. Example: Patch, Verdn

Donations: Similar to the eco-friendly options, these allow consumers to round up for charity or facilitate matching purchases for charity. Even if the merchant cannot directly monetize them, the merchant benefits from the increased checkout conversion and halo effect on their brand. Example: DailyKarma, Pledge

Subscriptions: This is somewhere between the second and third wave of POS products, as it’s both a payment method and a different product (i.e., recurring vs. one-time purchase). Merchants realize the power of recurring payments, and shifting a consumer from a one-time or episodic purchases to a subscription is a huge improvement to the average e-commerce business model. Examples: Skio, Recharge

Most of these categories are large and have analogies in traditional and offline commerce. However, this list just scratches the surface of the opportunities here.

Second-order opportunity: checkout / payments orchestration

The proliferation of POS products is a win for merchants and consumers. However, it increases operational complexity for merchants. For example, merchants must manage the integration and interoperability of these products, not to mention toggling various products based on factors like the buyer’s geography, order size and contents, risk, etc.

Companies like Primer handle this for payments and go deep into the payments stack, including routing to different acquirer processors, risk engines, etc. But there may be an opportunity to expand the scope of such orchestration products as the scope of products at POS expands.

People may joke about how crowded POS has become, but I see it as a sign of innovation in the area. If you’re building something here or thinking about it, I’d love to hear from you. It’s never too early to talk to us, but it can be too late! mb@matrixpartners.com

¹ Note that I use POS and checkout interchangeably. They’re generally any place a buyer pays for something. This is most commonly the checkout page of an e-commerce site, but it can also be an offline experience such as Square’s terminal and/or Cash Pay.

² If you haven’t already read it, I highly recommend this history of Paypal (”Paypal Wars”). The technological, regulatory, and competitive challenges they faced make today’s fintech environment seem like a cakewalk in comparison.