Invisible asymptotes in vertical software

Why the future of vertical software will be more “vertical” and less “software”

TLDR

Vertical software experiences regular evolutions, where the winning companies offer a broader and more complex product suite for the vertical. For example, the first generation of vertical software was primarily verticalized point solutions (e.g., project management for construction), but today’s vertical winners bundle multiple software products (e.g., CRM, workflow management, billing) with multiple embedded fintech products (e.g., payments, lending, payroll).

This broadening of the product strategy has two benefits: (1) it helps startups differentiate against incumbents, and (2) it helps expand the addressable market by increasing the revenue each customer can generate.

However, even this model will hit decreasing returns. Even if a startup supplies 100% of the software and financial services to companies in a vertical, it will only capture a fraction of that vertical’s overall value.

So, a new model is emerging: startups are not just offering bundled software and embedded payments, but more importantly, some other product or service that helps new businesses start and existing businesses grow. And most importantly, these startups have found ways to capture more of the growth from this upside than previous models ever could.

The Red Queen dynamic, named after the character from Lewis Carroll's "Through the Looking-Glass," is an evolutionary concept that describes the arms race between competing species. Species must continuously adapt and evolve to survive in a changing environment. It’s like what the Red Queen tells Alice: "It takes all the running you can do to keep in the same place."

Investing in fintech and software, I sense that the Red Queen dynamic in these markets is ratcheting up in a way that may not be widely apparent yet. To understand where the dynamic is going, let’s understand where it started.

Software is dead, long live software

Established markets like software and fintech often have a dominant strategy at a given time. That strategy combines technology, business or pricing models, and product shapes, all of which are interrelated and exert a push-pull effect on one another.

This dominant strategy changes over time. As strategy X dominates a market, startups will often use a new strategy Y that’s more complex, expensive, or difficult in some way but gives them an edge in displacing incumbents using strategy X. Eventually, the challengers become incumbents. All the survivors have adopted strategy Y. The cycle starts again with new challengers adopting strategy Z, which is even more complex, expensive, and expansive than X or Y. This is the Red Queen dynamic.

Starting in the 2000s, the dominant strategy for most B2B categories was to build a single product, target a horizontal or at least a broad market, and monetize through SaaS. Think of the companies founded in 1995-2010, many of which are now public, like Salesforce, Docusign, Zendesk. I call this “SaaS 1.0”.

As those companies grew and dominated their categories, the Red Queen dynamic ratcheted up. Startups needed to do something different, more, and better to compete.

2005-2015 represents the era of “vertical software” or “vertical SaaS.” These companies targeted specific verticals but also monetized via SaaS. Their vertical focus was the common denominator. Some focused on a single product for a vertical (e.g., Gorgias doing support or Klayvio marketing for ecommerce). Others embraced a multi-product approach, often including non-software financial products, like payments (e.g., Mindbody doing scheduling and payments and more for fitness studios).

Starting in the late 2010s, there was a variation to vertical software that I think is significant enough to warrant its own label, which I called “vertical ERPs.” These focus on a specific vertical, are multi-product with both software and embedded financial products like payments, and, most critically, attempt to become that vertical’s system of record by orienting their multiple products to create, capture, and expose the core data for that business. These companies will often describe themselves as the “operating system for <<vertical>>” or “all-in-one <<vertical>> management platform.” Some examples of this include Cents (”One system powering your entire laundry business”) and Clio (”Everything your law firm needs. All in one place.”).

To recap, in software and adjacent fintech spaces, there’s been this accelerating evolution of dominant strategies:

One important note: One era’s incumbents will adopt the new era’s dominant strategy once it’s eventually proven. Some do it slower and reluctantly, while others are faster and more proactive in adapting. For example, Shopify launched its software product in 2006 and then Shopify Payments in 2013, solidifying it as a pioneer in embedded payments monetization. Clio launched in 2008 and focused on multi-product software for many years until launching Clio Payments in 2021, which were critical to doubling their revenue ahead of their recent fundraise. So this constant adaptation to the currently dominant model is a vital part of what keeps the Red Queen dynamic going.

There’s still a lot of upside and growth for companies running the Vertical ERP strategy. I’m constantly surprised at how much more software businesses are willing to adopt and move even critical parts of their financial stack into software via embedded products.

However, I’m also seeing the Red Queen dynamic ratcheting up again—with the emergence of a new, more expansive, complex, and lucrative strategy.

Expand the model, expand the market

New strategies are competitive not only because they’re differentiating from the incumbents but also because they greatly expand the vertical’s total addressable market (TAM). These points are critically linked: to justify increasingly expensive and vertical-specific investments necessary to compete, each new vertical software model must generate more revenue from the same customers than the older model could.

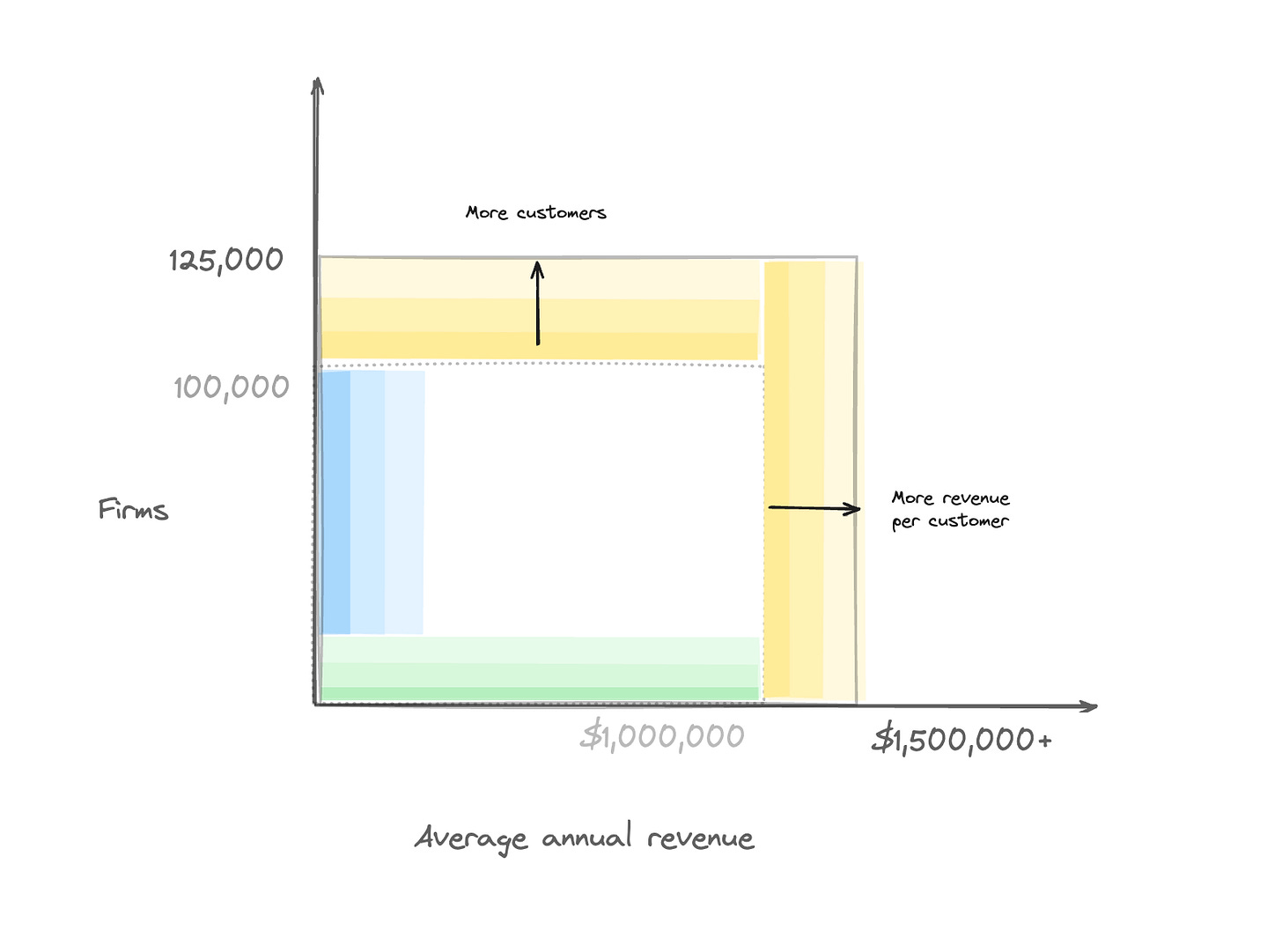

Let’s see how market sizing evolves with each new strategy using an example from the legal services market. To simplify the math, say there are 100,000 small to mid-sized law firms in the US, with an average of 10 employees each and average top-line revenue of $1M.

Horizontal and vertical software 1.0 models often charged a fixed monthly fee per user (e.g., $49/user/month). So the TAM equation for these models would be the following: Price per seat * Number of seats. So that’s $49/month * 12 months * 10 users * 100,000 firms, or a TAM of $588 million. A big number, but not venture scale. Even if you doubled or tripled the price per seat, the market is still limited by the number of seats and price per seat.

The Vertical ERP model builds on and breaks this limitation by embedding financial products. Payments is often the first financial product embedded. Most importantly, in the case of payments, this monetization is not fixed by the number of seats but is variable with the revenue each customer generates. Vertical software companies have a low take rate in payments (i.e., 0.5-1.0% of incoming payments), but this number is large when applied to the entire market.

Returning to our example, under the vertical software model, you could expect each law firm to generate $5,880 of annual revenue ($49 / seat * 12 months * 10 seats). By monetizing payments, that same firm represents an additional $5,000 annual revenue ($1M * 0.50% take rate). This doubles the potential revenue per customer, which justifies the increased scope and complexity of the product.

This is the current dominant strategy in vertical software. Many companies are adding multiple software products and increasing per-seat prices, as well as adding payments and other embedded financial products, like banking. Each additional product differentiates them from incumbent companies without that scope and increases the amount they can generate from each customer. That, in itself, is a big competitive advantage.

Eugene Wei wrote an article on "invisible asymptotes", which are the unseen barriers that limit the growth of a product, company, or market. These are the factors that, regardless of effort or investment, prevent further progress. For example, in the early days of Amazon, Jeff Bezos identified shipping costs as a potential invisible asymptote. He realized that no matter how much they improved their website or expanded their product range, high shipping costs would always limit their growth. This insight led to the creation of Amazon Prime, a program that offered free shipping and effectively removed this invisible asymptote.

Vertical software models have their own asymptotes. For SaaS-focused ones, it was the number of potential seats in a company and the amount that could be charged per seat. Even if they captured 100% of the seats in a company and charged a high SaaS fee, the overall spend on software would still be a small fraction of the expenses or revenue of the business. This product and pricing model was the asymptote.

So the next-generation vertical software companies embedded payments and other financial products, where they captured a portion of the revenue (via embedded payments) and expenses (via embedded issuing and banking). This greatly expanded the TAM, but it’s still limited by the number of companies in the market and their revenue. These models push the limit out a bit, but there’s only so much revenue you can generate from existing businesses by making them incrementally more efficient.

This model still has a long way to go and will be competitive for a while. Recent data I put together showed that embedded fintech adoption in vertical software was relatively low. However, just like the fixed per-seat model set a ceiling for the TAM of earlier strategies, the number of companies in a market and their topline revenue set a ceiling for the transactional model of Vertical ERPs.

However, a new model is emerging. The new model could challenge the currently dominant one. Like the previous evolutions, this new model differentiates itself by solving a broader set of challenges with a more comprehensive product offering, which opens more monetization opportunities in each market and thus expands the TAM further.

While previous strategies made existing businesses more efficient, these emerging models do that, plus help create new businesses and grow existing ones. How they accomplish this varies by vertical. But the net effect is that they expand their markets, and capture a more significant share of upside in that newly expanded market.

It’s early, but the Red Queen dynamic is in effect again. Companies need to do more to differentiate from incumbents, expand the capture, and then capture a more significant share of what they capture:

Vertical X, or variations of vertical software

This next generation of vertical software is exciting because it’s much more “vertical” and much less “software” than anything that’s come before. What does that mean?

Previous generations of vertical software companies solved horizontal problems in a verticalized way. They offered many of the same fundamental products but with tweaks to data models and workflows. For example, Procore offers project management and field productivity tools for construction companies, and Clio does the same for law firms, it’s just called case management and time & expense tracking. They look different and are called different things, but many of these features and products “feel” the same across verticals today.

That’s why I call this new model “Vertical X.” It’s not only or even mainly software, but it’s also not just one thing. It’s inaccurate to call them “vertical marketplaces” or “vertical payments.” Many have those components and everything you’d recognize in vertical software 2.0 or Vertical ERP models. But this next generation sells something more: solutions to vertical-specific problems.

This next generation is anchored around solving vertical-specific problems in vertical-specific ways. These vertical-specific problems vary widely, but they all relate to some limit to growth in that vertical. The solutions to the invisible asymptote of growth in these markets typically fall into one of three categories:

Reduce barriers to starting new businesses

Wrangle and retain fragmented demand

Make “at scale” pricing or products accessible

All of these are fundamentally about solving the question of scale. In a fragmented market, what advantages do the largest companies have that the smaller ones cannot access because they’re too small? For example, how can a local restaurant owner run a version of the McDonald’s franchisee playbook for greater efficiency? How can a small coffee shop get a version of Starbucks’ loyalty app and bulk pricing? How can a solo medical practitioner get a larger medical group's insurance coverage and back-office support?

Examples of “Vertical X”

I’m going to list a bunch of examples of companies that are using this new strategy. There’s a high-level pattern across all these new solutions. They differ from previous vertical software strategies in two meaningful ways:

First, this newer generation of solutions focuses more on external relationships (e.g., with suppliers, customers, and regulators) than on internal processes (e.g., project management expense tracking).

Second, the solutions to these problems are more than just software. They involve a mix of modalities, including marketplaces, content and education, regulatory constructs, and novel financial products.

Reducing barriers to starting new businesses

There are markets where demand far outstrips supply. In the long run, the market balances this out, but supply bottlenecks can still exist that smart founders are finding ways to unlock and monetize. The cause of these bottlenecks (and thus the solution to them) varies widely by industry.

In some markets, the bottleneck is specialized knowledge, training, or a honed industry playbook. For example, companies like Moxie help people start medspas. They offer verticalized software and payments, but they differentiate by providing 1:1 guidance from a Launch Director and Medical Director and ongoing guidance and coaching. Other companies offer lighter versions of this, such as MoeGo’s offering for new pet care businesses, discounted software, and dedicated coaching and content to help them succeed.

In other markets, the bottleneck is credentialing and/or approval from critical partners, such as regulators or insurance providers. For example, it’s onerous for newer or small medical practices to get “in network” with various insurance providers. However, the more insurance plans they accept, the more patients they can take. Companies like Headway in mental health and Berry for dieticians help medical professionals get credentialed and in network. The folks at Slow Ventures have published great stuff on this as it applies to medical verticals.

Last, other markets face the bottleneck of upfront capital requirements for otherwise lower-risk businesses. In another take on the medical market, companies like Provide help doctors, dentists, and veterinarians get access to the capital to acquire an existing practice or start a new one. They even offer “dedicated project managers with loan closing and construction management experience” for ground-up construction of new medical facilities.

Acquiring, converting, and retaining fragmented demand

Demand is fragmented in many verticals. Even though customer acquisition is critical to any business, owners often don’t have the time, resources, or expertise to focus on it. In many verticals, owners would happily pay for incremental customers from sources other than paid search or social.

There are several ways that vertical software companies help their customers acquire and retain new customers. In the past, these strategies have been add-ons for companies at scale, but younger companies are starting to offer these services sooner, too.

One strategy is for the vertical software company to develop a buyer-facing brand and product, add value to that buyer-facing product, and then drive that demand to their customers. One example is Mindbody, which started as a vertical software company for fitness businesses and has since launched a consumer-facing brand for consumers to find and book classes. Shopify’s consumer-facing Shop App, which has a store directory, along with deals and shipment tracking, is another example.

A lightweight version of this is to build buyer-facing products that facilitate conversion but are less branded and don’t try to capture users at the top of the funnel. For example, few consumers would start looking for take-out food on Toast, as they don’t have a marketplace as far as I know, but once they pay with Toast Payments, it’ll save that consumer’s payment details for easier checkout next time. A very different example comes from Hearth, software for home contractors that leads with embedded financing. A major constraint on home improvement projects is the homeowners’ ability to pay. Contractors can reduce that friction and increase conversion by offering financing directly to the homeowner through Hearth.

In addition to vertical software companies with unique acquisition and conversion products, many now embed everything from “do it yourself” to “do it for me” marketing tools into their broader suites. Features to build SEO-optimized websites, capture customer interest, and market to customers are increasingly common. Others, like Topline Pro, will go further and manage paid search and even print ads for local home services businesses. Companies like Hoist use AI to qualify and price leads for home painting businesses, while Supermove provides an “AI Sales Copilot” for moving companies to close and upsell more customers.

Make “at scale” pricing or products accessible

This is a particularly exciting category because it can have the most disproportionate effect on a market’s TAM and the opportunity for a vertical software company to capture it. The idea is that there are things that larger companies can do because of their size that give them some advantage, but these have been inaccessible to smaller companies – until now.

One underappreciated but critical aspect of businesses with a physical component is their procurement of physical goods. Businesses at scale have much more leverage to negotiate better prices from their suppliers. Starbucks pays much less for the same pound of coffee beans than your local independent coffee shop, just like the regional healthcare system pays much less for bandages than your local doctor’s office. Companies like Gather and Faliam offer procurement and group buying discounts in medical, while Odeko handles the entire procurement system for coffee shops.

Another emerging trend is enabling sub-scale businesses to offer competitive services and lucrative products previously accessible only with scale. For example, having a dedicated sales team that can immediately answer, qualify, and convert customer calls is a big advantage but comes with high fixed headcount costs. Companies like Drillbit offer AI lead answering, qualification, and follow-up that make the top-of-funnel experience for smaller companies indistinguishable from that of larger ones. Other companies focus on offering entirely new products, like Dandy, which offers outsourced dental lab services to smaller dental offices, or Cents, which enables local laundry businesses to offer pickup and delivery.

The benefits of extreme vertical focus

Many “Vertical X” companies start with one differentiating solution, but the best compound the benefit of their vertical focus by layering on multiple over time.

Returning to our first example of Moxie. In addition to the deeply vertical software and fintech products, they offer the training, playbook, and ongoing support to help businesses start and grow. However, they also have deep relationships with pharma companies, whose products account for ~40% of a medspa’s COGS. A single medspa operator wouldn’t have the scale or time to build those relationships and get bulk discounts, but Moxie does and can. It passes those savings onto its customers to further invest in their businesses.

Similarly, Moxie is directly involved in acquiring, converting, and retaining customer demand. Moxie runs the entire marketing function for these businesses, from top of funnel down to lead management. They can amortize their learnings and strategies across multiple medspas, generating better results than a part-time local marketer could alone.

Moxie is a pioneer of this model and executing it well. It requires deep product and operational expertise. However, as the benefit of this more full-stack approach becomes apparent, it will become more common among the winners in each vertical.

Own the businesses

There’s another evolution of vertical software that I think is fascinating but is different enough from the categories above that it deserves a separate mention. The idea is that rather than sell software and services to businesses, you actually own the businesses and operate them more effectively with proprietary tools.

This is best articulated by Slow Ventures’ excellent “growth buyouts” thesis, which is worth a read. The idea is that the ideal way to monetize certain verticals is to build vertical software that gives you an edge in that market, buy an operating company, apply that product to the company to help it grow, and then repeat. Tidemark’s Michael Tan has a great take on this as well, “Are Tech-Enabled Vertical Roll-Ups the Future or the Past?”.

For example, Metropolis, a parking software provider, raised $1.7B to acquire a national parking lot operator. The idea is that it could get a greater return by having free rein to apply its technology to those physical assets than by selling it as software. Others are trying this with smaller transactions and more service-based verticals, such as Splash in pool servicing and OLarry in accounting.

Conclusion

The most successful startups are founded when there’s some shift – in technology, business models, distribution, or ideally all – that allows them to quickly displace incumbents and capture a greater share of a growing market. Vertical software has undergone several such shifts over the past decades, with new models emerging that solve more problems in each vertical and expand its TAM. We’re in the early stages of another such shift, and likely one of the largest expansions of TAM yet, as the creative use of new models helps grow and capture more upside of these verticals than ever before.

My name is Matt Brown. I’m a partner at Matrix, where I invest in and help early-stage fintech and vertical software startups. Matrix is an early-stage VC that leads pre-seed to Series As from an $800M fund across AI, developer tools and infra, fintech, B2B software, healthcare, and more. If you're building something interesting in fintech or vertical software, I'd love to chat: mb@matrix.vc