The secrets to pricing payments in vertical software

Payments are the secret weapon of the best vertical software companies, like Shopify and Toast. It’s not uncommon to see 2-5x increases in revenue, retention, and other metrics once a platform successfully embeds payments. It’s now easier than ever to start with payments, thanks to companies like Stripe. But it’s more difficult than ever to succeed with payments.

I call this the “embedded payments iceberg”. Many companies think that a few lines of code and hours of work will yield a whole new monetization model. However, integrating payments is just the tip of the iceberg, and real success requires more than product and engineering work. One of the most important yet least appreciated aspects of a successful payment strategy is pricing.

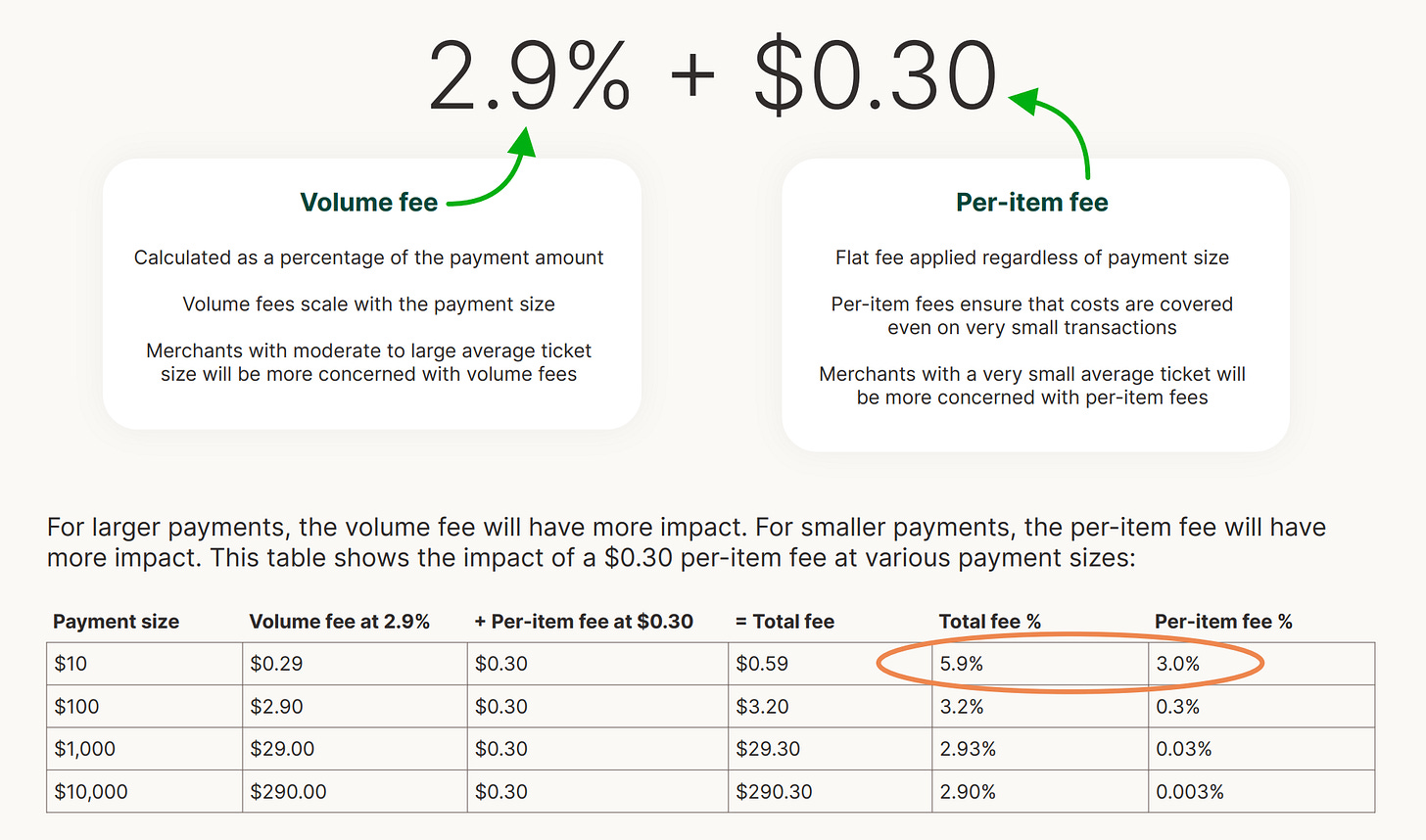

It’s not as simple as slapping a 2.9% + $0.30 fee on card transactions and calling it a day. There are many levers to pull in pricing payments. The right set of levers depend a lot on the vertical software platform’s market, its existing product suite and pricing strategy, and more. Seemingly small decisions on payment pricing can mean the difference between no adoption on one hand or lots of adoption but low or negative revenue on the other. It’s challenging to find the right balance and strategy.

Rainforest1, which offers embedded payments to vertical software platforms, recently released a free guide on payments pricing that should be required reading for anyone who has or is considering embedded payments. It’s available for free, with no registration required:

I suggest you download and read it, but I’ll summarize some of the most important points below.

Start by learning as much as possible about how your end customers accept payments today

The ideal payments pricing strategy for your platform hinges on the mix of payments your customers receive. Are they typically large or small? There’s a big difference between a coffee shop with an average order value of $5 and a B2B marketplace with order values of $5,000. The former should care more about the per-item fee, while the latter should care more about the volume fee component:

How do your customers’ customers pay? Even if it’s mostly through card, what kind of card? There are key differences between debit and credit cards, personal and business cards, domestic and international, Mastercard/Visa versus Amex. understanding this will help set a strategy for interchange plus, flat, or blended pricing:

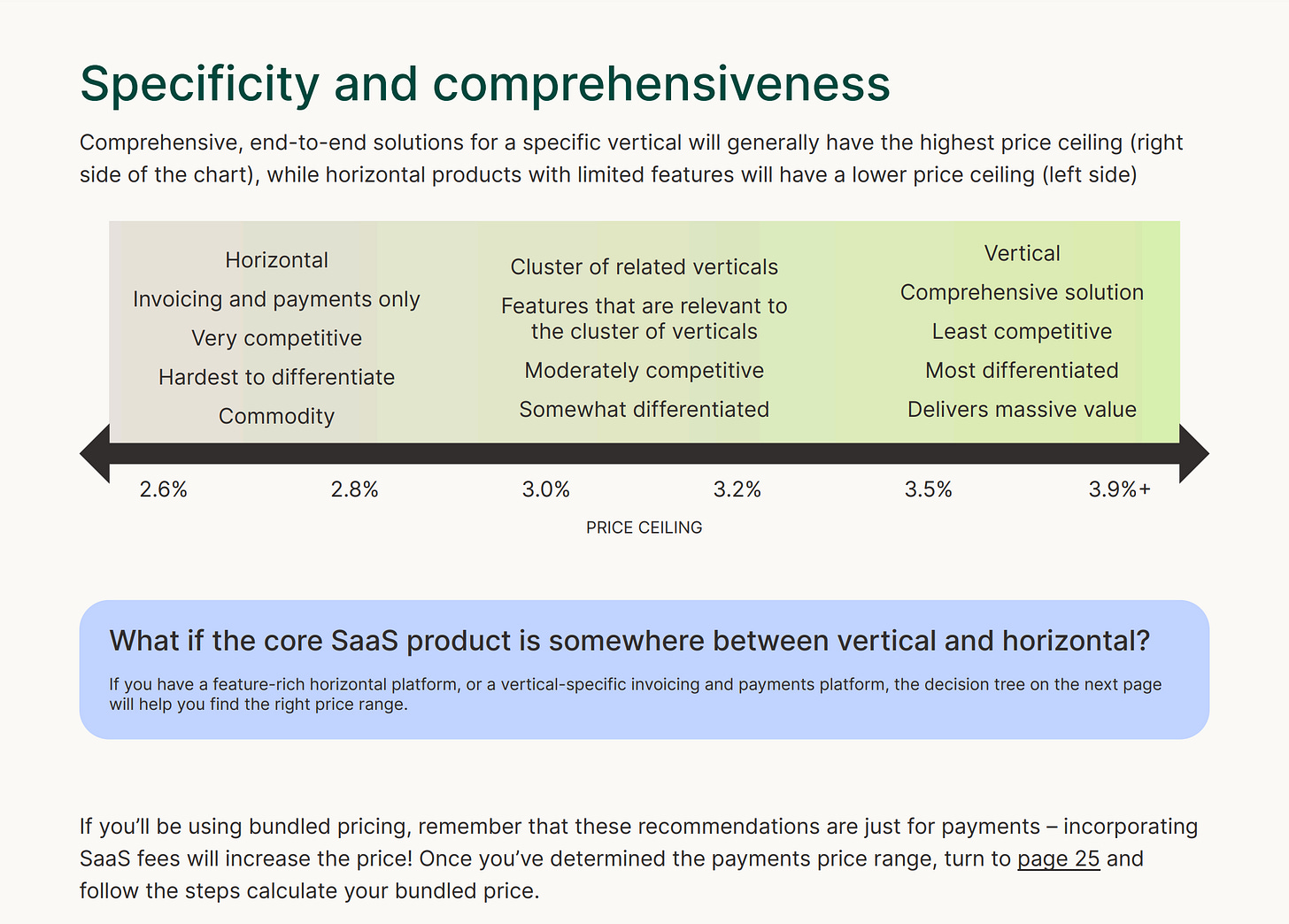

Understand how comprehensive and specific your solution is, and how competitive and well-defined your market is to determine price ceilings

While many think 2.9% + $0.30 is the payment market rate, some platforms have more pricing power. To understand that power, consider factors like how comprehensive and critical the base software platform is, how narrowly defined your ICP is, and how unique embedded payments are in your vertical:

The implementation and pricing of payments allows for different ways of recognizing payments revenue, which affects a company’s valuation

There are a couple of ways to recognize payment revenue, which will affect your finances differently. If your company plans to raise money or be acquired, it’s critical to understand how investors or acquirers will evaluate your payments revenue and its effect on your margins.

I won’t spoil the rest of the guide, but it’s worth a read for anyone who cares about succeeding in embedded payments:

And if you’re considering adding or improving payments, it’s worth chatting with Rainforest. They have decades of combined expertise in payments and vertical software. The platform is excellent, but their service and guidance in navigating that “embedded payments iceberg” makes them the new secret weapon for vertical software companies. You can find there here: Rainforest.

My name is Matt Brown. I’m a partner at Matrix, where I invest in and help early-stage fintech and vertical software startups. Matrix is an early-stage VC that leads pre-seed to Series As from an $800M fund across AI, developer tools and infra, fintech, B2B software, healthcare, and more. If you're building something interesting in fintech or vertical software, I'd love to chat: mb@matrix.vc