The thermodynamics of risk

Fintechs reduce cost and friction—but risk is conserved. The winners don't avoid risk. They transform it into a type they're built to manage.

Risk, like energy, cannot be destroyed: only transferred or transformed.1 Call it the thermodynamics of financial services.

Every financial transaction involves risk: uncertain exposure that someone must bear. A loan might not be repaid. A payment might be fraudulent. A counterparty might fail. Someone is always holding this exposure.

Risk is balanced by cost. Interest rates on loans. Interchange fees on payments. Spread on foreign exchange. You take the risk, you get paid for it.

Risk is also balanced by friction. The three-day settlement window. The paper application. The in-branch visit. These delays make risk more manageable. Friction is another form of cost (implicit rather than explicit, paid in time and conversion rather than dollars).

Fintechs reduce both cost and friction. Lower fees. Faster approvals. Seamless onboarding. The pitch is simple: same product, better experience.

But reducing cost and friction doesn’t reduce risk. That’s the thermodynamics at work. The risk remains, conserved in the system. The friction you removed was managing something. Where does that exposure land?

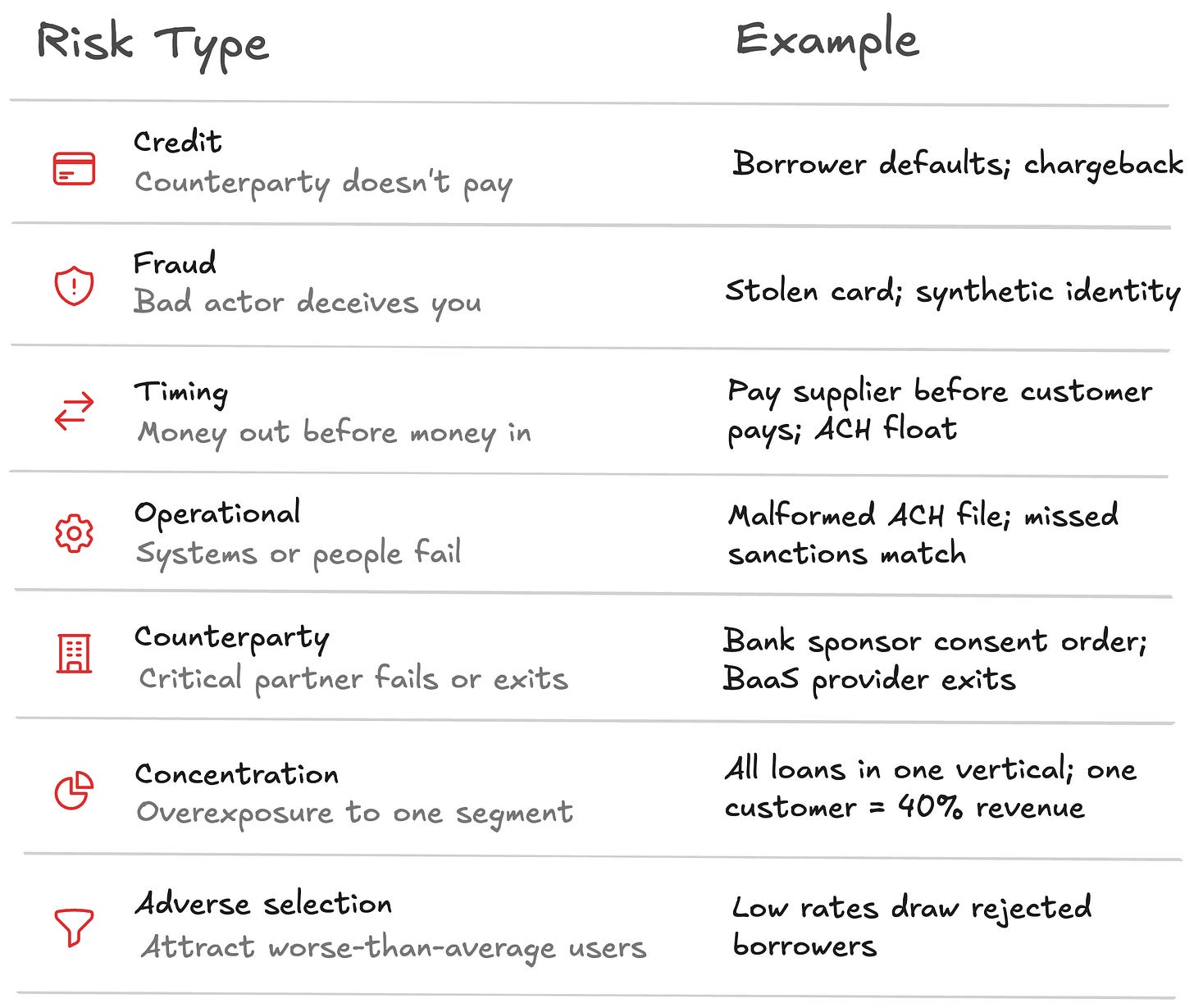

Risk takes many forms, including:

Each requires different capabilities to manage. Being good at credit risk doesn’t make you good at fraud risk. Operational excellence doesn’t help with concentration.

This creates an opportunity. A process change, a new data source, or a different product structure can shift risk from one form to another. A company with a specific edge in data, technology, or operational discipline can deliberately transform risk into a form they’re better equipped to manage. The goal isn’t to avoid risk. It’s to hold the right risk.

The difference between success and failure is whether this transformation is intentional. Reducing cost and friction without understanding the new risk you’re holding is how fintechs blow up. The ones who win recognize the transformation and build specific capabilities to handle it.

In each of these examples, notice the trade: what friction came out, what risk moved in, and what capability the winner built.

Square (underwriting risk → fraud and chargeback risk)

Traditional payment processors manage risk through friction: site visits, reserve accounts, manual underwriting. The merchant is vetted before they ever process a transaction. Square removed that friction, letting anyone accept payments instantly. But the risk didn’t disappear; it transformed. They won because they built real-time detection systems designed for fraud and chargebacks. They deliberately traded a risk managed through slow process for a risk they could manage through technology.

Toast (credit risk → operational and concentration risk)

Traditional lenders manage credit risk through friction and cost: lengthy applications, document collection, credit checks, high interest rates. Toast removes that friction for restaurants on their platform. A restaurant can get capital with minimal paperwork, underwritten on real-time transaction data flowing through its point-of-sale system. Concentration risk cuts both ways: their entire loan book is restaurants, so when COVID hit, the whole portfolio was correlated. But focusing on a single sector means deeper knowledge, purpose-built software, and better underwriting for that specific business. They win when depth of insight outweighs concentration exposure.

Buy now, pay later (consumer credit cost → provider credit risk)

Traditional card payments balance risk through cost: merchants pay interchange, consumers pay high APRs if they revolve. BNPL changes the equation. Merchants pay a higher fee (4-8% vs 1.5-3%) but shed chargeback exposure and gain conversion lift. Consumers get interest-free financing. The BNPL provider absorbs credit risk that was previously managed with high APRs. Companies like Affirm and Klarna are betting they can manage this through short durations, transaction-level underwriting, and merchant-funded economics. They win when underwriting keeps losses below the merchant fee. They lose when credit losses spike and the math stops working.

If you’re building a fintech that reduces cost or friction, ask yourself: what risk are you now holding? The friction you removed was managing something. Do you have data, technology, or expertise that makes you better at managing the new form? Or are you just hoping it doesn’t materialize?

Risk can’t be destroyed. But it can be transformed, and the best fintechs turn that transformation into their advantage.

My name is Matt Brown. I’m a partner at Matrix, where I invest in and help early-stage fintech and vertical software startups. Matrix is an early-stage VC that leads pre-seed to Series As from an $800M fund across AI, developer tools and infra, fintech, B2B software, healthcare, and more. If you’re building something interesting in fintech or vertical software, I’d love to chat: mb@matrix.vc

For the physics-minded: diversification and better information can reduce risk at the portfolio level (that’s the point of insurance). But compression in one dimension creates exposure in another. Diversify across a thousand borrowers and you’ve traded idiosyncratic credit risk for systematic risk and operational risk. The risk isn’t gone; it’s reshaped. Squeeze it in one place and it bulges out somewhere else.