Stablecoins in 1,000 words

Stablecoins are an exciting and powerful upgrade to financial technology, both in their own right and as a complement to traditional fiat money movement. Here's a brief intro to how they work.

Several years ago I backpacked from Berlin to Beijing, covering much of the distance in a third-class car on the Trans-Siberian Railway through Russia and Mongolia. One night I was shaken awake at 3 am on the Mongolian-Chinese border by what felt like a derailment. I jumped out of bed and stared bleary-eyed out the window as railway workers detached each carriage from its wheel assembly and swapped it for one that fit the Chinese railway gauge.

Many countries have different tracks, either by design or historical accident, so many trains require different wheel assemblies to cross borders. Most passengers later woke up in the same carriage they fell asleep in, now traveling through a different country on different rails and wheels.

There’s more to money than money

I thought of that Mongolian railyard often as I started learning about stablecoins1. Before that trip, I thought rail cars and their wheels were all the same, all purpose-built for the tracks they ride on, which are more or less the same globally. But that’s not true. Carriages, wheels, and tracks are separate but related elements, are designed and built with various priorities2, and are different worldwide.

The same is true of money and the financial infrastructure it’s built on. Neither is valuable without the other, so each is designed symbiotically, resulting in benefits and trade-offs.

Fiat currencies like US Dollars (USD) and Euros (EUR) are issued and managed by central banks and governments, who also help create and regulate their underlying rails. This centralization makes these currencies stable and useful, but it also restricts how the rails can be used and who can use them. Think of fiat currencies as safe, comfortable, and highly desirable railway cars that ride on rails that can be slow, opaque, and inaccessible to many. There are some differences between the rail systems of different countries, but they’re generally interoperable if you have enough time and money.

The blockchain and associated decentralized infrastructure gave rise to thousands of cryptocurrencies. While the infra was fast, global, permissionless, and transparent, the currencies themselves were often too volatile to pass the major tests of money. There’s plenty of value and utility in various cryptocurrencies. Still, none of them could be used as a day-to-day transactional currency – like there’s value and utility in assets like gold, but you still wouldn’t use it for transactions daily.

If fiat currency is an old-school railway system, blockchain is a magnetic levitation (meglev) train. It was open source, permissionless, and globally available, so anyone could build their own tracks and cars. This led to many valuable and interesting new vehicles and lines. Still, few wanted to ride them regularly or on long journeys since they weren’t comfortable, reliable, or safe at first.

Because this maglev system was so new, sometimes dangerous, and certainly long-term competitive, the older rail systems made interoperability difficult. They didn’t want maglev trains riding their rails.

But it was easy enough to retrofit the older but safer and more comfortable carriages to the fast, futuristic, and global rails. That’s effectively what stablecoins are: the best of both worlds. They are reliable cars that can ride on traditional or futuristic rails, switching easily between the two and connecting different rail systems.

Between and within financial systems

Stablecoins have several valuable use cases between and within different financial systems.

The first is as a bridge between the fiat and crypto worlds. In this case, the value was more in the currency itself (and its stability) than in the infra. Stablecoins allow crypto users to store and exchange a stable form of value on chain3. Access to a global, nearly permissionless form of stable digital currency also helped people in countries without a stable local currency.

The second emerging use case is parallel infra within a fiat system or between different fiat systems. In this case, the value is in the stablecoin infra as much if not more than the currency itself. Because stablecoins are fast, cheap, global, and programmable, they’re promising complements or substitutes to traditional money movement products like cross-border payments, treasury management, and settlement. In this use case, the end users might not even know they’re using stablecoins, but they’re attracted to product benefits like speed and cost.

The third emerging use case is in building de novo stablecoin products that exist within the fiat world, where the value is in both stablecoins themselves and their infra. The idea is to offer the benefit of stability without the downsides of centralization. With fewer intermediaries and more transparency, money can move faster, cheaper, and more securely. This is still evolving, but interesting applications are appearing, such as stablecoin-only banks.

Making and moving stablecoins

The most common type of stablecoin is fiat-collateralized: one stablecoin represents and can be redeemed for one unit of fiat currency – i.e., 1 stablecoin (USDT, USDC) = 1 USD. Other variations include asset-collateralized (e.g., gold), crypto-collateralized, and algorithmic stablecoins. We’ll focus on fiat-collateralized since it’s the most common and straightforward to understand.

Stablecoins are created by issuers, who create (“mint”) or destroy (“burn”) stablecoins in exchange for fiat, and partner with others to facilitate this exchange, increasing the use and indirectly the value of their stablecoin. Issuers monetize the float on these deposits.

Issuers mint stablecoins onto various blockchains, third-party (e.g., Ethereum) or first-party (e.g., Ripple). Different blockchains offer different features and benefits, such as increased throughput or security, and many stablecoins are compatible with multiple blockchains.

For example, say Alice wants to buy $100 of USDC. She sends $100 USD to Circle, which stores the fiat in their trust account at a bank. Circle then mints 100 USDC coins on the blockchain and sends them to Alice’s on-chain wallet.

Alice can send the USDC from her Circle wallet to Bob, who sends it to Carol. These are all nearly free and instant transfers since all three make transfers on the blockchain. However, each person treats the 100 USDC as if they were $100 USD, since they effectively are a claim on the $100 USD stored with the issuer. Let’s say Carol needs to convert her 100 USDC to USD: she sends it back to the issuer, who destroys the stablecoins and releases the equivalent in fiat to Carol.

It’s inefficient for end users to interact with issuers for every transaction, so they’ll partner explicitly or rely implicitly on liquidity providers, such as exchanges, OTC desks, financial institutions, or other market makers. These maintain pools of fiat and cryptocurrencies, often exchanging them for a spread on each transaction. This can be as simple as buying small amounts of USDC with fiat from Coinbase rather than from Circle, or more complex, like cross-border use cases where stablecoins are exchanged for an exotic local fiat.

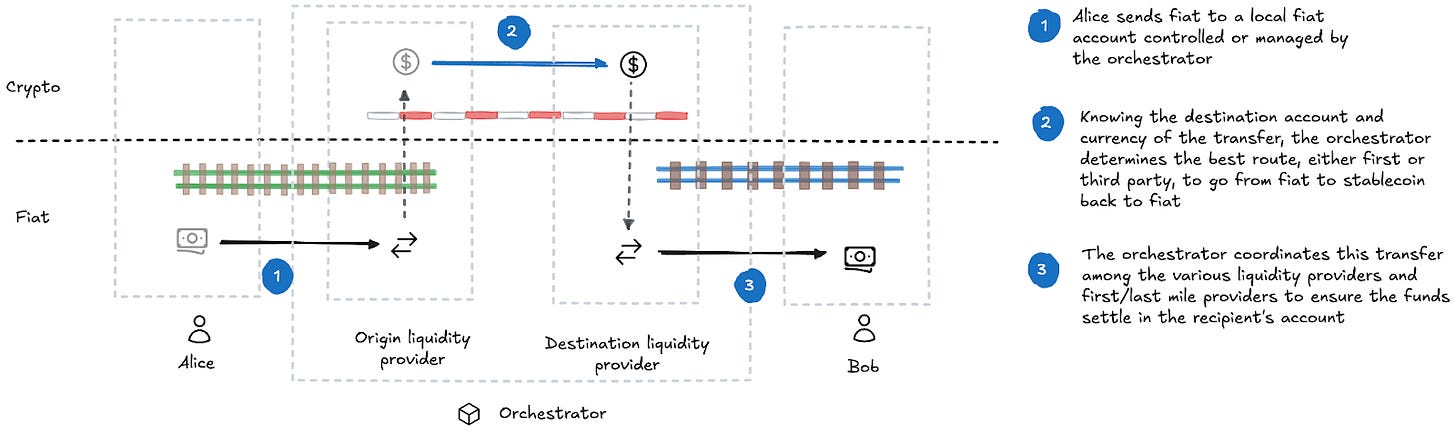

Some stablecoin use cases, such as payments and remittances, are more complex. For example, say a company wanted to allow its users to send USD to various Latin American countries. It would need to support on- and off-ramps in different countries, maintain various first- and last-mile fiat infra, do KYC on senders and recipients, and manage liquidity pools for several currencies. It could also work with orchestrators, like Bridge, which handle the complexities of these funds flows and regulatory requirements.

Other players are beginning to emerge, such as businesses that look like more traditional merchant gateways, but for crypto (e.g., Transak, MoonPay), as well as stablecoin-native applications, such as Zarpay and Dakota.

The multi-billion dollar question is: Where does value accrue in the rapidly evolving stablecoin stack? The lines between these categories are already blurred. Some applications are building their own orchestration (e.g., Sling Money) and some liquidity providers are deeply partnering on issuance (e.g. Coinbase, Circle). The lines between these stablecoin layers are also blurring with the fiat world, whether it’s through building (Visa’s Tokenized Asset Platform), buying (Stripe + Bridge), or partnering (OKX and Singapore’s DBS). Although the end state of stablecoins is uncertain, the journey will be exciting!

As a reminder, I’m a partner at Matrix, an early-stage VC firm that invests in fintech and areas like AI, B2B, infrastructure, healthcare, and frontier tech. I focus on fintech and vertical software and am particularly interested in stablecoins. If you’re building or interested in the space, I’d love to hear from you: mb at matrix.vc

The modern financial and railway industries co-evolved in the last two centuries and borrowed many terms and analogies from each other, such as payment rails, wire transfers, and even interchange.

For example, Russia’s wider railway gauge was designed to withstand heavier loads, more extreme weather, and rougher terrain and make invasion by foreign armies more difficult, but it’s more expensive and limits interoperability.

This reflects a common pattern in technology described by Carlotta Perez’s book "Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages" (2002). Perez describes recurring cycles of "installation" and "deployment". During the installation phase, speculative financial capital drives the spread of new technologies, often leading to bubbles, which later burst. The deployment phase sees productive investment harnessing the technology for broader economic and societal benefits. So it wouldn’t be a stretch to say the greatest threat to SWIFT and Visa ultimately came from Bored Apes and Dogecoin, albeit indirectly.