Vertical AI: beware what you wrap

Why vertical AI should fear the systems of record below them and not the AI around them.

Forget being dismissed as a ChatGPT wrapper. Anyone building vertical AI should fear being a wrapper around a system of record.

The loud debates over “AI versus software” frame the choices poorly. They obscure the right strategy for each player in the emerging stack: incumbent vertical software, emerging vertical AI, and general model companies. Let’s look at how that stack started and is evolving.

The evolving software stack

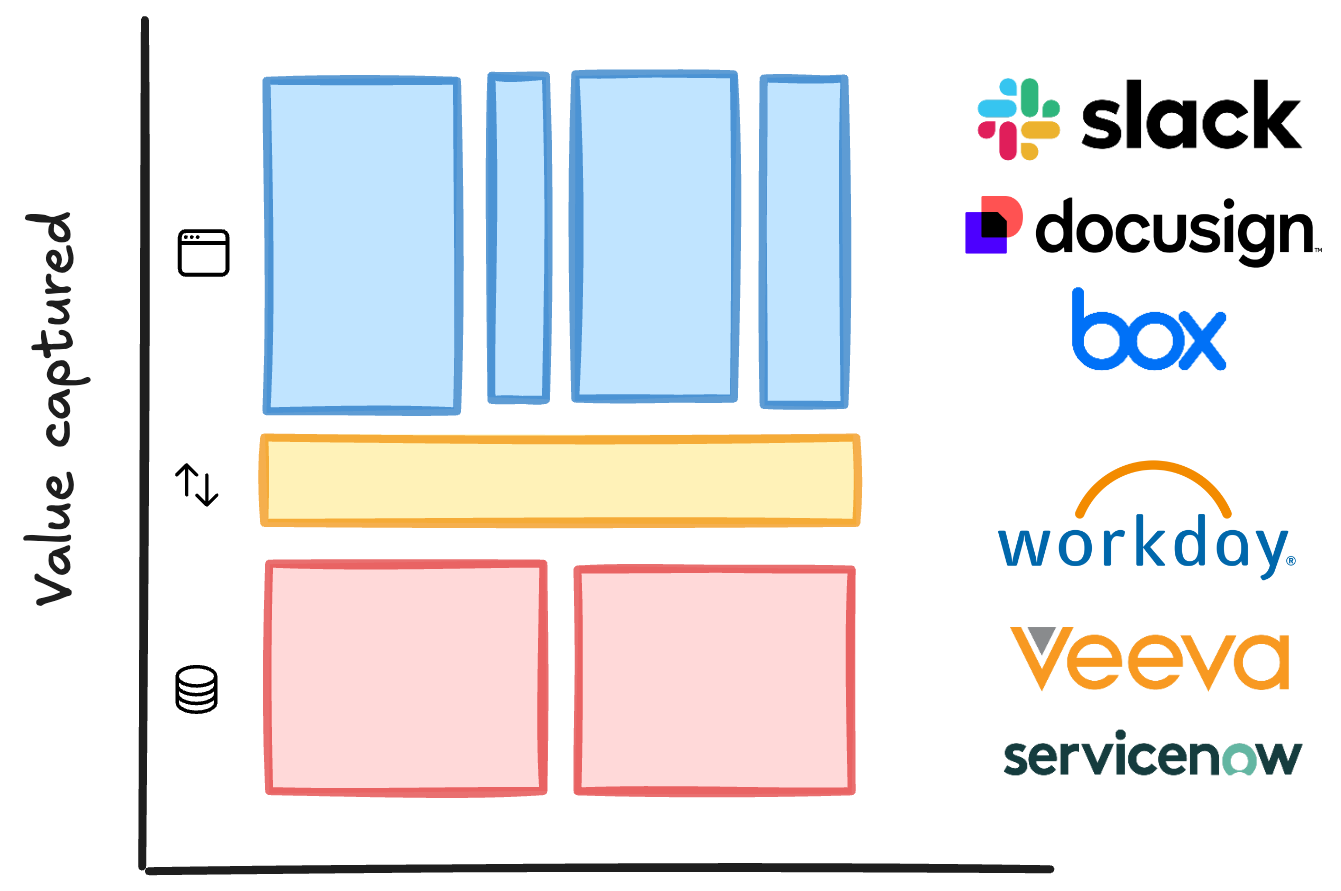

The classic software stack has three layers:

This architecture applies to single software products and companies' broader software stack. Businesses need reliable sources for important data like customers, expenses, and revenue. Employees generate this data in fragmented and sometimes conflicting ways. For example, information about a customer may be spread between the teams and tooling in sales, implementation, and billing—but it must ultimately be synthesized and reconciled into a single place.

The relative value of these layers has changed as software has evolved. In the early software age, only a handful of vendors existed. The winning ones developed all-in-one solutions and systems of record. They centered on vital business resources: employees (human capital management, HCM), customers (customer relationship management, CRM), and revenue/expenses (enterprise resource management, ERP). In this model, most of the value accrued to databases like Oracle, SAP, and Salesforce.

SaaS made software cheaper to create and distribute. This broke down interaction systems into many specialized apps. During this time, there were notable SOR IPOs like Workday, ServiceNow, and Veeva. However, SOE companies like Docusign, Box, Zoom, Slack, and Smartsheet really defined the era. They created value by digitizing and streamlining employee workflows.

The latest evolution of this stack is vertical software (vSaaS). It combines the SOI and SOR into one product designed for a specific vertical. For example, Clio for lawyers, Housecallpro for field services, Brightwheel for schools.

A single product in a vSaaS bundle is likely weaker than a general option. For example, Clio’s CRM isn’t as strong as Salesforce’s. However, lawyers still prefer Clio because it’s purpose-built for them and integrates with all the other modules that Clio provides. For example, a prospect in Clio’s CRM can be turned into a client, so lawyers on Clio can track time, assign work, bill hours, and get paid.

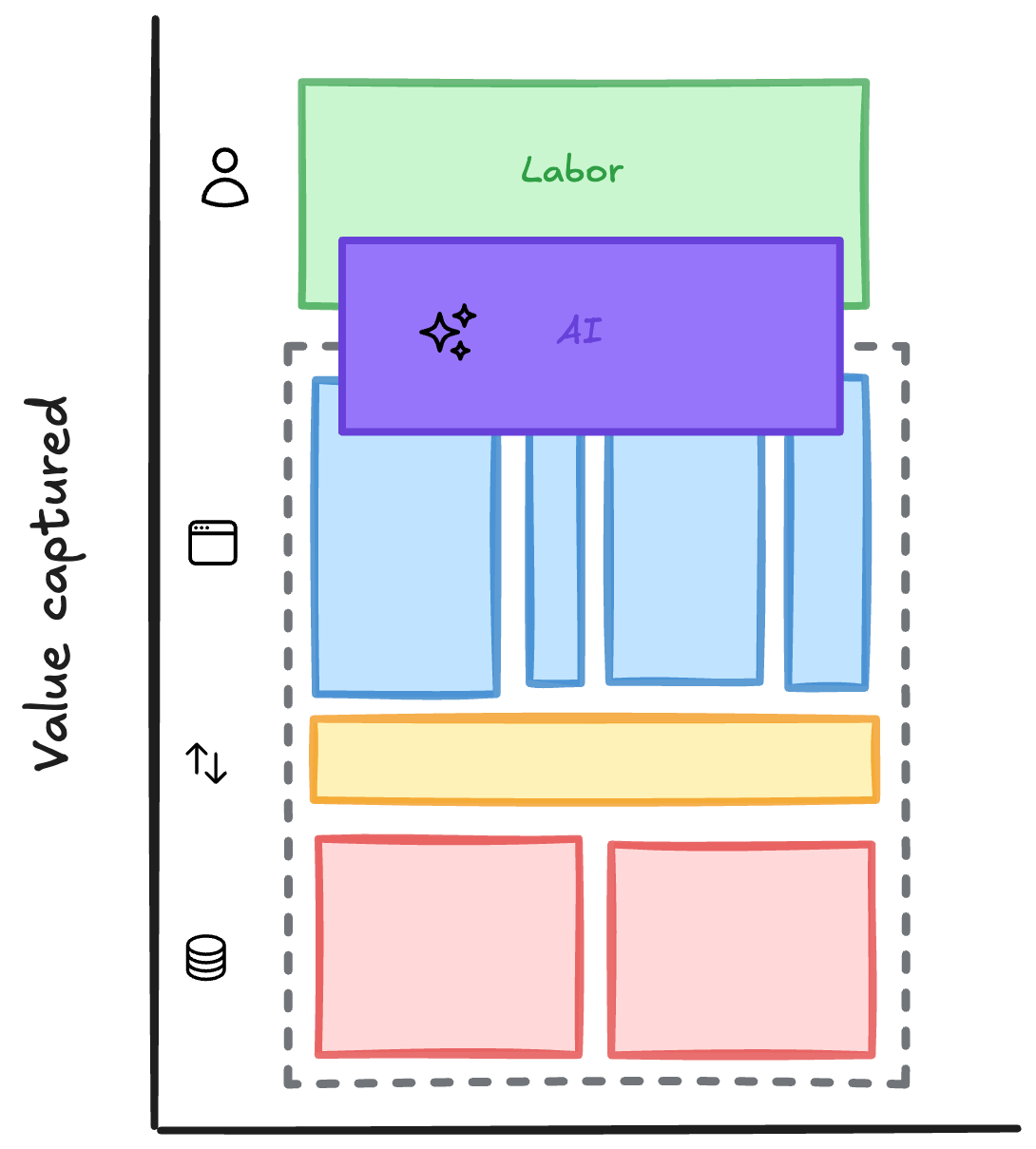

Enter AI

Vertical AI is shaking up the stack again. It comes in many flavors. Co-pilots augment labor and workflows. Agents offer a more invisible “do it for me” value proposition. AI is also making software easier and cheaper to build.

Intelligence is becoming cheaper. The software for interacting with it is also more affordable. Everyone thinks this means every business will build their own software. Or that they won’t need to build software per se because the intelligence at the interaction layer will be nearly free.

What becomes more valuable if intelligence is cheaper and the interactions with it are cheaper? It’s the data model for a vertical, the data for a specific business that fits its vertical data model, and the workflows and controls necessary to use that data to fit that specific business or industry. Or—put another way—a system of record.

AI rock and a hard place

Let’s take a hypothetical example in the roofing market. “ShingleSoft” is a vSaaS for roofing companies. It has a full suite of software products: CRM, estimates, scheduling, project management, inventory management, time tracking, payroll, billing and payments, accounting, etc.

“RoofGPT” is an AI-focused startup. It knows that many roofing companies can't hire full-time sales, marketing, and operations employees. Many sales calls to roofers go to voicemail while the employees are up on roofs. So RoofGPT offers a voice agent. It picks up on the first ring and qualifies customers. It’s the equivalent of having infinite smart and polite salespeople ready near a phone 24/7.

The problem is that these “salespeople,” no matter how smart or skilled, are disconnected from the business. They’re perfectly capable of requesting numbers for a callback, and answering deterministic questions about operating hours. But they struggle when they’re asked about something that an employee sitting in the roofer’s office would know.

“Can I reschedule my inspection?” requires access to the roofer’s CRM to look up the customer record and the employee schedule.

“Can I pay my bill over the phone and can you send me a receipt?” also requires access to the CRM, invoicing, and payments system.

If all the roofing companies use a fragmented suite of tools (e.g., CRM from Hubspot, scheduling from Calendly), RoofGPT could build API integrations with all of them. However, for many verticals, these functions have been consolidated into a single vSaaS, like ShingleSoft. This is a double-edged sword for RoofGPT. They can interact with a single platform to create and update records across multiple functions. But they’re also beholden to that single vendor. Suppose they choose not to integrate. Suppose they focus on providing excellent voice functionality without direct access to the SOR. In that case, they’ll face commoditizing pressure from increasingly capable horizontal AI tools (e.g., OpenAI’s Operator).

So RoofGPT is facing two pressures. First, the pressure of increasingly capable and commoditized intelligence. Second, the pressure of increasingly centralized, rare, and controlled data and interaction with the vSaaS providers.

ShingleSoft isn’t an AI-native company, so they may be slower to build AI features. They may already have a robust API and partner ecosystem, so they may support RoofGPT initially. However, the core strategy of vSaaS is clear: bundle, bundle, bundle. The more products they offer, the more roofers they can acquire and the more they can charge. As outlined in “Invisible asymptotes in vertical software”, successful vSaaS know they need to (1) solve as many problems as possible and (2) find monetization models beyond SaaS that both drive growth/success of their customers and capture more of that upside and growth.

“Pretty good” products that are deeply embedded into the core vSaaS product are likely to beat “Excellent” products that lack deep integration and lack platform distribution.

Put another way, if I’m a roofer, which of these options would I prefer?

(A) the world’s best salesperson, but they’re stuck in a room alone with no access to live info about my business

(B) a decent salesperson who is deeply familiar with business, services, schedule, and employees

Most would probably choose (B). That’s especially true if the gap between the quality of the salespeoples’ standalone skills keeps shrinking every month.

Choose your wrapper wisely

Every business is a wrapper. To be flippant, SaaS companies just wrap cloud providers, which wrap cloud hardware providers, which wrap semiconductor foundries. Being a wrapper is not in itself a bad thing. What you wrap and how you wrap it makes it bad or good.

Especially if you’re wrapping a commodity, you must give customers a reason to buy from you versus going direct. You can do this with product (by improving or adding value to it). You can also do it with distribution (selling it cheaper and/or more effectively than customers could get it themselves). Having one is good, having both is better.1

Today vertical AI agents are primarily wrapping product, building something novel enough that it’s getting them powerful distribution. However, there’s a limit to how much value they can add without owning or accessing the SOR. At the same time, “good enough” intelligence is being commoditized. I doubt intelligence will ever be so commoditized that the end B2B user relies exclusively on agents. But I think it will be sufficiently commoditized enough to seep into adjacent software products. It’s already happening. Successful vSaaS companies are expert bundlers. They’ve mastered multi-product motion. They also have existing distribution through their install base. And because they are the SOR, they can build an integrated experience much better.

So what’s the right strategy here? Will vAI or vSaaS win?

Emerging vAI companies have a harder path to success than they thought. Early fast growth will taper off as they, their customers, and vSaaS partners realize the value of integrating with the SOR (and limits of not being integrated with it). vAI companies should ignore the FUD around the “end of software” and have a clear plan to displace the SOR. This may apply less to vAI companies in verticals without a modern vSaaS incumbent. They’ll have an easier time starting with an AI wedge and building out the SOR rather than displacing another one.

Existing vSaaS companies are net beneficiaries of AI commoditization. It’s likely a sustaining rather than disruptive innovation to them. They have more time to make strategic moves in offering their customers AI products, whether by building, buying, or partnering.

Embedded AI for vSaaS is a newer category, empowering vSaaS to add vAI features faster and more successfully. This is different than simply embedding AI. It involves configuring AI to help vertical-specific workflows, such as marketing and customer support (e.g., Reach). Think how companies like Rainforest or Stripe enable vSaaS to embed payments rather than become payfacs themselves.

The dynamic between vAI and vSaaS is reminiscent of the early days of the streaming wars. There was competition between Netflix (a streaming platform that licensed content) and HBO (a content company without a streaming platform). In 2013, a Netflix exec famously said, "The goal is to become HBO faster than HBO can become us." The right answer wasn’t streaming or content but both together.

It’s worth noting that most of the major streaming services today are “full stack.” They own the content production and tech. They’re about evenly split. Around half started with streaming and got into content production (Netflix, Amazon Prime Video, Hulu, Apple TV). The other half started as content producers and got into streaming (HBO, Disney, Paramount, Peacock). I expect something similar will play out in B2B software, where the winners in vSaaS will own the IP (customer data and workflows), not to mention existing brand and distribution, and layer on the new tech.

The dichotomy of AI versus software is a false one, especially in B2B verticals. They complement each other, and each vertical’s winner will thoughtfully combine both.

My name is Matt Brown. I’m a partner at Matrix, where I invest in and help early-stage fintech and vertical software startups. Matrix is an early-stage VC that leads pre-seed to Series As from an $800M fund across AI, developer tools and infra, fintech, B2B software, healthcare, and more. If you're building something interesting in fintech or vertical software, I'd love to chat: mb@matrix.vc

Think of cloud storage, something rare that turned into a commodity. Dropbox started off making this rare/difficult-to-use resource usable to the average person. It’s still a great company today, but as storage became commoditized, the winners in B2B/B2C are the ones that had an existing distribution advantage because of existing customer relationships and/or had products that enhanced the use/value of commodity storage (Apple’s Photos, Google’s Gmail and Photos and Drive).