Dark software

How the SaaS and fintech models are breaking down — why food delivery and dark kitchens provide an alternative model — what the future of software may look like as a result

TLDR

The last decade’s playbook for building startups is breaking down, particularly in SaaS and fintech. Founders need a new playbook to create winning startups. But what will the playbook (and the winners) look like?

“Dark kitchens” in food delivery might offer a hint: they’re able to win in highly commoditized, low-friction markets with hyper-specialization, a full-stack product offering, and everything outsourced except the brand and integration.

The new model for startups will be that of “dark software”: combining fintech and SaaS products from different vendors into a seamless, full-stack offering for hyper-specialized segments. This will have profound implications for founders and investors.

Traditional SaaS and fintech models are broken

Many founders are realizing that the last decade’s model1 for building SaaS and fintech products just doesn’t work anymore. Stagnant or declining growth, high and rising CAC, declining LTV… all are symptoms of this breakdown.

These problems are adjacent to but independent of the recent pull back in venture funding. Even companies that build an excellent product, find product-market-fit, and grow with a sharp eye towards unit economics will need to run harder just to stay in place. Growth isn’t as fast, easy, or controllable as in the past.

What’s causing this breakdown? There’s too great a supply of undifferentiated software chasing increasingly picky demand that’s also locked behind a small number of monopolistic platforms extracting ever greater margin to access that demand (search, social, app stores, etc). And how did we get here? In many ways, the software industry is a victim of its own success. It’s never been easier to build and distribute software products—so it’s never been harder to build a big business this way.2

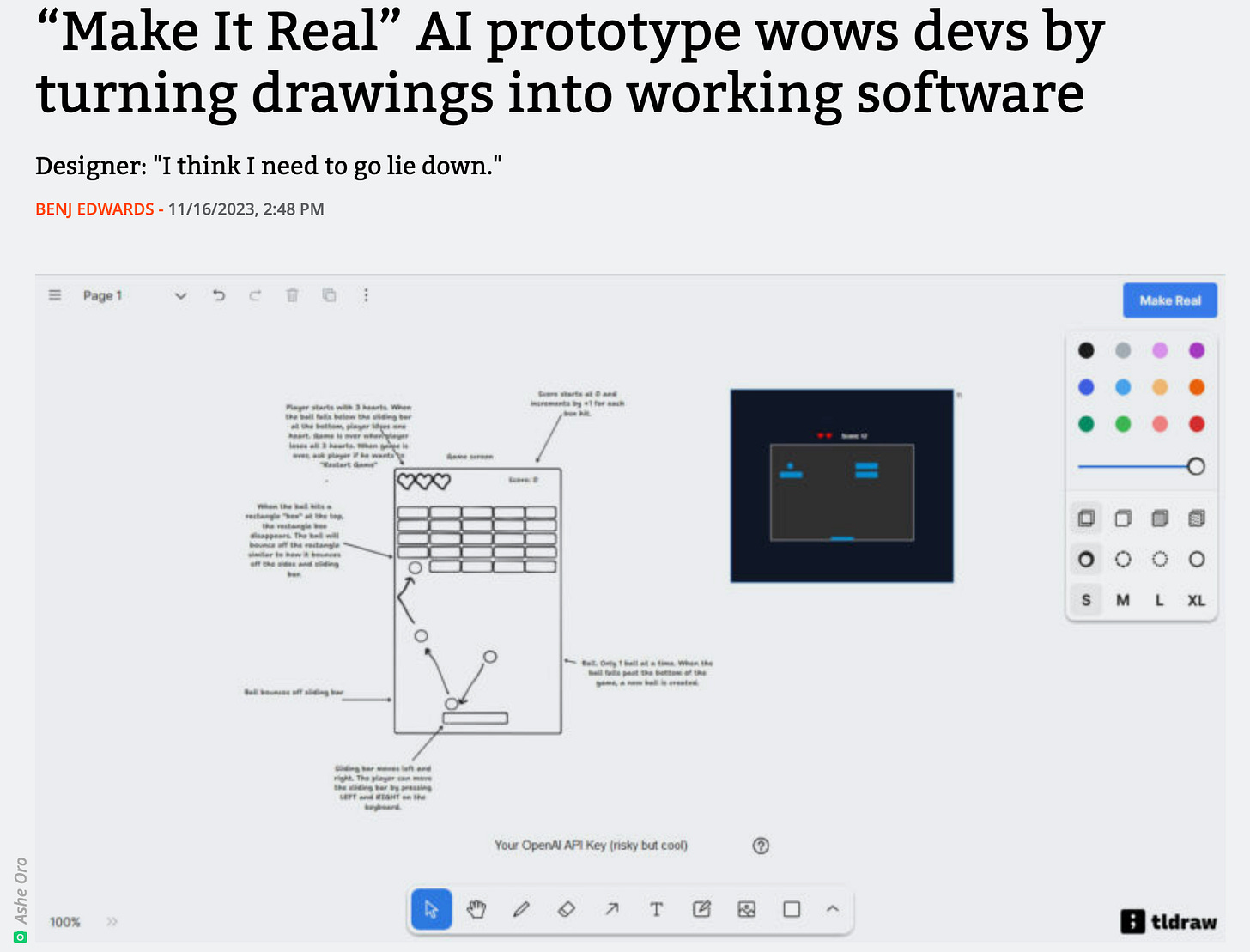

AI will cause these dynamics to spiral even faster, making software even cheaper and distribution more expensive. It’s still early, but there are plenty of fascinating examples of AI acting as an increasingly competent replacement for engineering. It’s not hyperbolic to think that soon every person, team, and company will have their own no cost design and development team. See Diagram, Vercel’s v0, and TLDR Draw.

On the other hand, AI will accelerate the competition and increase the cost to acquire users. Everything from producing SEO content to personalizing outbound sales will be cheaper and easier with AI.

So we’re facing saturation in software and fintech—there’s ever less room for startups to build big businesses. Breaking from this stasis will require a new operating model, a new way of thinking about and building companies that blend software and fintech. What does this new operating model look like? I think the world of dark kitchens might provide an answer.

Dark kitchens – food from first principles

Dark kitchens (aka virtual, ghost, or cloud kitchens) exist because of super successful food delivery platforms, including DoorDash and UberEats. These are kitchens that don’t offer any dine-in service, and probably don’t even have a sign on the building. But on DoorDash and UberEats, they have a name and a logo, much like any other restaurant. You might have ordered from a dark kitchen without even knowing it. The model is so powerful that Uber’s founder, Travis Kalanick, started one after he left Uber that was last valued at $15 billion.

To understand dark kitchens, think of a restaurant as a bundle of things designed to make food in exchange for money: a brand, a physical location for the dining area and kitchen, front and back of house staff, and tools for reservations, inventory management, and payments.

So what’s a dark kitchen? It’s a restaurant built from first principles for the delivery age. It’s an answer to the question: “Assuming there’s lots of demand for food delivery, then what’s the most efficient way to build a delivery-only restaurant?”

Say you’re the enterprising owner of an Italian restaurant on a busy street, Joe’s Ristorante. You start getting more delivery orders and it gets you thinking… Why limit your customer base to the people walking down your street and the size of your dining room, when your market actually is everyone ordering on DoorDash and Uber Eats? If you don’t need a physical dining room, you need less physical space, not to mention you don’t need to pay expensive rent on a busy street. So you close the dining room, move to a cheaper kitchen space, and keep making the same great food.

Then you take that thinking further… why limit yourself to a single brand and menu? You can run different brands out of the same, lower cost, more efficient kitchen. Rather than a single, middle-of-the-road brand and menu that appeals to the average person, you can specialize, segment your market, and price discriminate. You can run a high-end bistro, maybe upselling truffles and a wine pairing, while also running a low-cost pizza brand that upsells beer and wings. The couple on date night will open the app and order from “Giovanni’s Trattoria” while the new grads next door will order from “Joe’s Pizza and Wings”, without realizing they’re coming from the same kitchen.

This can lead to almost comical over-optimizations of the model, like the SF pizza restaurant that was running 70 different virtual storefronts:

If nothing else it shows the power and flexibility of the model. CloudKitchens makes the comparison between their model and a traditional restaurant clear:

This is all thanks to the delivery platforms, which (1) aggregate demand, (2) handle delivery and payment, and (3) encourage suppliers to outsource everything that’s not core to the business and specialize to win niches. This makes it easy to test new menus and brands, specialize, and move quickly towards the highest-profit options.

Not every restaurant could or should be a dark kitchen. But dark kitchens are an efficient way to operate a business in a hyper competitive industry with differentiated demand and commoditized supply components.

Dark software: a new model for SaaS and fintech

The dark kitchen model is powerful in highly competitive markets with commoditized supply, differentiated demand, and a few powerful demand aggregators in the middle.

This describes the restaurant market, but it also increasingly describes the software market. The cost of code is dropping (commoditized inputs). Software buyers are increasingly picky and expect products that suit their exact needs (differentiated demand). Google, Facebook, Apple, etc are making distribution both easier and more expensive (aggregators control demand).

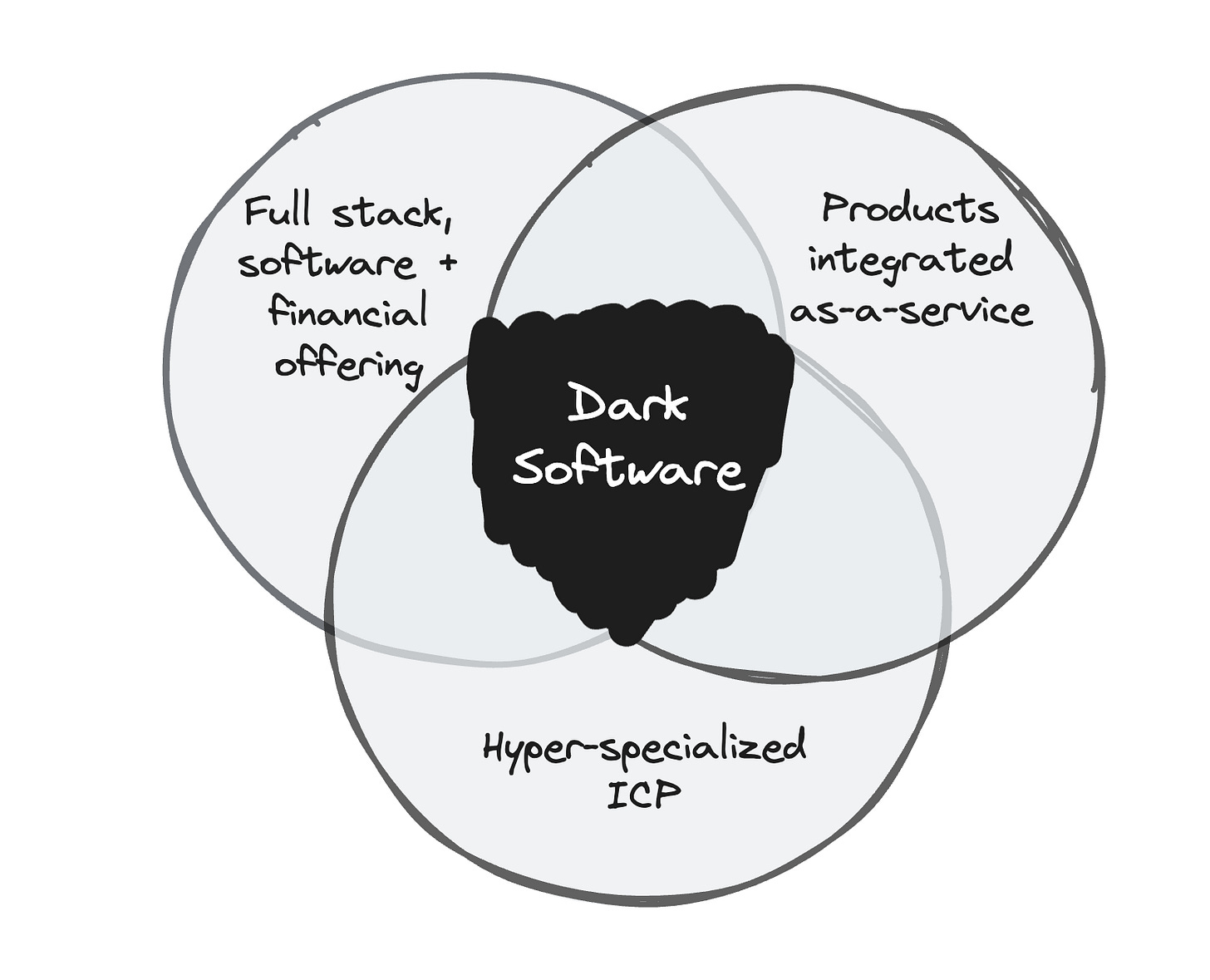

These dynamics require a new model, which I call dark software. It has three key points:

a hyper-specialized ICP to maximize conversion and minimize CAC. The narrower an ICP is defined, the more effective marketing and cost effective marketing dollars will be. Compensating for this narrower focus requires…

a full stack product offering to maximize LTV. This both compensates for and capitalizes on the narrower ICP focus: dark startups can sell more products to a narrower customer set rather than a narrow product to a wide set of customers. This means bundling multiple software and financial products, each of which were previously offered as point solutions by independent companies. Because these products span many areas and range in complexity, it’ll be difficult to build all in house, requiring dark startups to…

outsource the maximum amount of product to minimize fixed costs. Dark software will require much more product much sooner in a company’s life. It’ll be most economical for dark startups to act as a systems integrator of sorts for various third party providers of features. Much of today’s infrastructure is outsourced, but this will be extended to individual features as well. More on this below.

Here’s a hypothetical comparison of the old model versus dark software. A classic SaaS business would offer a point solution, say invoicing, to a broad set of companies and use cases, like SMBs. Nearly all of the product would be built in house, with a focus on making the core invoicing use case 10x better. It would be marketed through competitive channels on Google, Facebook, etc, targeting several broad ICPs that other traditional point solutions are competing for also.

On the other hand, a dark software company would start with a hyper-specialized use case, say small law firms in the US. Rather than start with a wedge product like invoicing, a dark software company would launch with multiple products on day one, like marketing tools, project management, time tracking, invoicing, payment acceptance, payroll, etc.

Nearly all those products would be integrations offered by third party vendors rather than built in house. This would require minimal product, design, and engineering headcount and reduce time to market. The dark software model is to offload entire, complex, and even user-facing features to third party, headless, and/or infrastructure providers and build much less de novo product in house. Instead, the focus of product development would be on seamless integration and a smooth, consistent experience across these various products.

You can rewrite CloudKitchen’s comparison table as a slide pitching the dark software model versus the traditional one:

This outsourced feature point is worth nothing because it’s relatively novel. Today vertical SaaS and even fintech companies will outsource financial products with regulatory or legal overhead, like payments to Stripe or lending to Oatfi or banking to Unit. But vertical SaaS companies still build much of their software in house, like CRM or scheduling or time tracking. A critical part of dark software is that even these software products will be bought from third parties.

The chart below shows this evolution visually. In the first iterations of the SaaS model, a company was its brand and ICP focus and GTM function (the dark blue exterior box) plus one or two products carefully crafted in house (the shaded blue boxes). The dark software model on the far right is one that continues to own and specialize in the brand and ICP focus and GTM function, but offers many more products from third parties that the company synthesizes into a cohesive whole.

Just like every restaurant is not a dark kitchen, not every software company will use the dark software model. Some will use the model entirely, others will use part of it, and some will stick to the traditional model. But the power of the new model in response to inescapable market forces will empower founders to build large and new businesses in an increasingly competitive market.

What are the implications of the dark software model?

Given how broken the traditional SaaS and fintech models are, I think it’s a question of how prevalent the dark software model will be, rather than whether it’ll be prevalent at all. Variations on this model already exist, from vertical ERPs to compound startups. But if dark software becomes even somewhat prevalent, it’ll have profound implications on the SaaS and fintech markets at both the app and infrastructure levels.

There need to be more embedded fintech players, and they need to bundle more products. I’m a big believer in and promoter of embedded fintech and fintech infra and think the market will be much bigger than it currently is. Not only will financial products get easier and cheaper to embed, but the embedded infra providers will aggressively bundle. Stripe is already doing this, as are others like BaaS leader Unit getting into lending. How far does this eventually go? Is the ultimate answer to combine payment facilitation and BaaS, for example? Time will tell, but dark startups will probably need a smaller number of infra partners offering more products.

There need to be more embedded software options (CRM, customer communications, etc). This is a relatively new category but I think it will also be significant. Even the most prosaic and seemingly commoditized software products (CRM, time tracking, customer communications) contain an incredible amount of complexity and depth. These will each need to be offered as a service to dark software companies looking to build full stack bundles quickly. Some current examples here include Layer (accounting), Twenty (CRM), Tailor (ERP).

Because every dark software company will use multiple products, they’ll need orchestration and a common data model. Some companies are already offering this as a solution to the bundling of fintech products, in the form of ledgers-as-a-service, like Fragment. This common data model and orchestration may extend to the software side as well, e.g., to connect a customer in a CRM with an invoice product with a payment in a payfac with the entry in an accounting system.

One winner will probably take all (or most) in each sub-vertical. For example, there won’t be many companies serving the pet care market, but one that owns >80% of it and has a significantly higher LTV than the sum of the individual products those customers previously used. There will be some churn as companies figure out what niches are viable as standalone markets and which are ghost markets (e.g., are coffee shops their own segment or a subset of QSRs?), but the equilibrium will be many small winner-take-most dynamics.

There may be an opportunity for a company to build the infra themselves and launch many vertical products under different brands with shared resources. This is something of a lovechild of the original Rocket Internet model and Kalanack’s CloudKitchens, or maybe a modern version of the “keiretsu” that KPCB tried to build in the Dot Com era.

I think dark startups will offer a powerful alternative to the currently weakening models in software and fintech. Like any new category and model and playbook, there will be much trial and error, with lots to be built and learned.

My name is Matt Brown. I’m a partner at Matrix, where I invest in and help early-stage fintech and vertical software startups. Matrix is an early-stage VC that leads pre-seed to Series As from an $800M fund across AI, developer tools and infra, fintech, B2B software, healthcare, and more. If you're building something interesting in fintech or vertical software, I'd love to chat: mb@matrix.vc

The “SaaS playbook” is something like: start with a wedge product, do customer development around it, build an MVP, charge a subscription, decrease payback by adding annual plans, have expansion paths to manage net revenue retention, spend as much as you can to acquire users through paid ads and/or in/outbound sales and marketing with a reasonable payback. The “fintech playbook” is much the same, but with the added caveat of building atop one infra provider that determines your economics, like a BaaS.

On building, the cost to create software has fallen dramatically over the last 10+ years. This resulted from the proliferation of the cloud and X-as-a-service offerings, open source frameworks and developer tools, low and no code tools, and the acceptance of remote work and globalization of talent. All of this has driven the cost of custom software development ever lower. On the fintech side, infrastructure players like Stripe and Unit made it easier to build financial products, even highly complex and heavily regulated ones.

On distribution, user acquisition has never been easier thanks for search and social ads platforms, and that’s made it more competitive and expensive to acquire users profitably. The large tech companies — from Google in search to Facebook in social to Apple in mobile app stores — have aggregated an incredible amount of demand behind their platforms over the last decade. The ease of reaching billions of people in a targeted way led to a crowding of the distribution channels, which in turn raised acquisition costs.