Embedded fintech in 1,000 words

What do airline loyalty plans, tractor loans, and iPhone insurance tell us about the future of financial services and the evolving role of fintech in software?

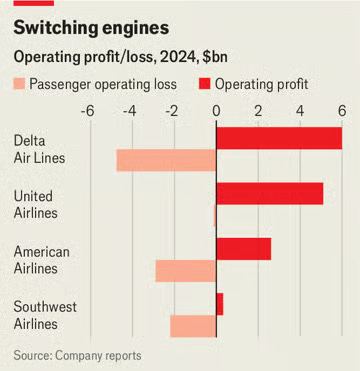

You might’ve heard the joke: airlines are just credit card companies that happen to own planes. It isn't far from the truth. Loyalty program fees generate the bulk of US airline profits.1

Airlines represent an increasingly common pattern: X is just a [bank/lender/issuer] that sells [unrelated, non-financial product].

Examples include auto and equipment manufacturers like Toyota and John Deere, which have extensive financing arms, homebuilders like D.R. Horton, which offer vertically integrated mortgage origination, and wireless carriers like AT&T, which earn hefty fees from device insurance and financing.

Why embedded fintech wins

Modern software platforms have transformed this pattern into a powerful strategy that’s upending financial services and software alike. Restaurant owners no longer go to Wells Fargo for their card payments, they go to Toast. Landlords no longer wait in line at Chase to deposit checks or get loans, they use Yardi, etc.

These platforms—from the multi-billion-dollar pioneers like Toast, Shopify, and ServiceTitan to the crop of upcoming challengers—all represent the new strategy of embedded fintech, or when a non-financial company offers financial products that are highly contextual, curated, and customized for the company’s existing customers.

To appreciate the power of embedded fintech, consider the contrast between customers in line at the airport and those at the bank. Airline passengers may be very different from each other—different ages, different income levels, different reasons for traveling, different travel frequencies, and so on. But they all have one thing in common: a need to fly. Meeting that need is the airline’s main job, and they spend aggressively to fill seats on their planes. But airlines are notoriously low-margin businesses, and now that they have a captive audience, they see a cross-sales opportunity too good to miss. Airline credit card and loyalty schemes are designed to cross-sell relevant, complementary products to this captive audience.

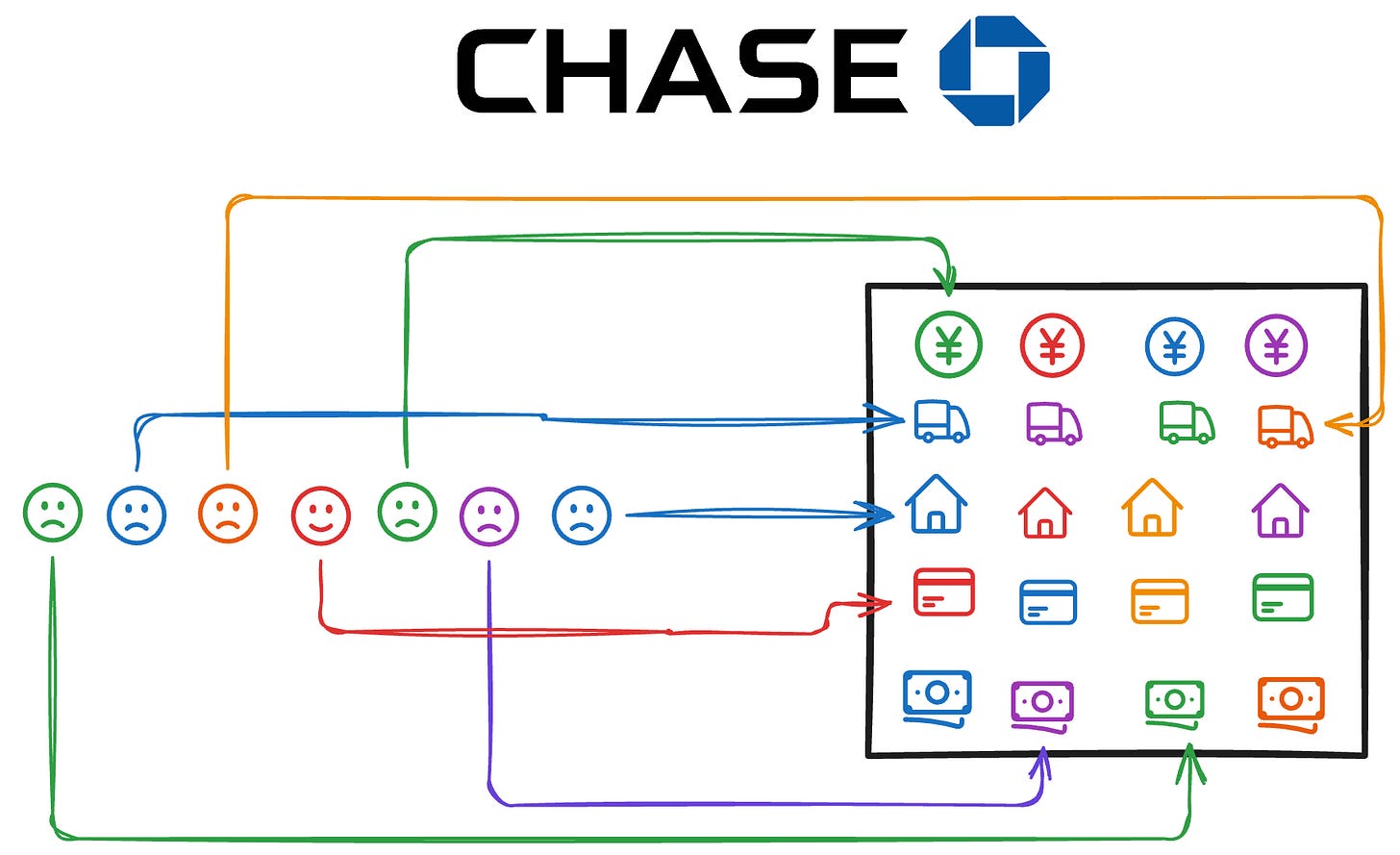

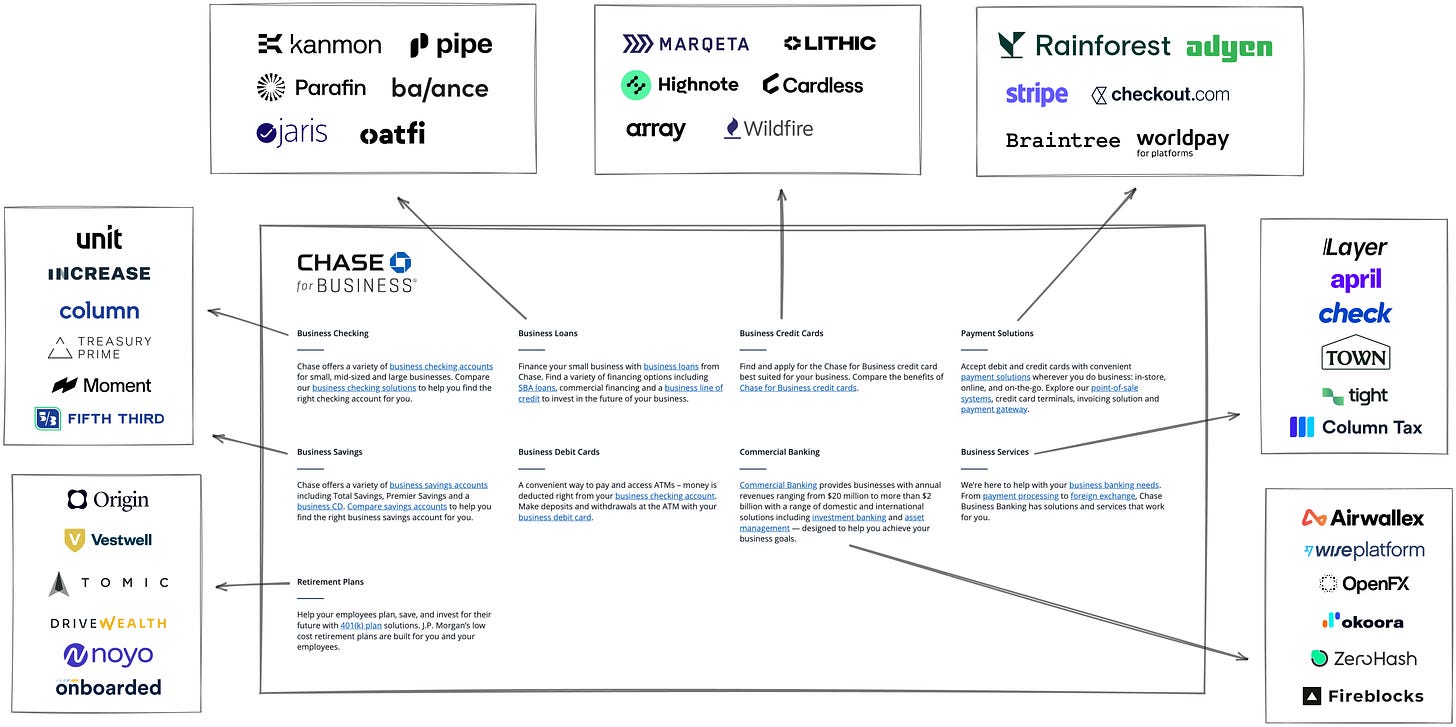

Contrast the airport line with the line at your local bank. The people here are more diverse than at the airport, as are the services they’re waiting for. You may be next to a restaurateur setting up card payments, a construction company owner applying for a loan, new parents opening a 529 account, and a local lawyer opening a checking account. To appreciate the diversity, just look at the online product offering from Chase: everything from checking accounts to Disney Visa Cards and private banking to home mortgages and cross-border payments.

Both airlines and financial services are highly competitive industries. Both spend aggressively to acquire new customers, and both try to sell new customers as many products as possible to cover their acquisition costs and increase retention. The difference is that bank customers are so diverse that it’s impossible to customize an experience for them. Airline customers, by contrast, have just enough in common that it’s possible for airlines to customize experiences for them. That ability to customize is what gives embedded fintech its power.

How embedded fintech works

Platforms with embedded financial services (PEFS) have been at the forefront of refining embedded fintech. PEFS like Shopify ($190B market cap), Toast ($25B), and ServiceTitan ($10B) are nominally software companies that serve well-defined customer segments or needs: Shopify is the one-stop shop for ecommerce merchants, Toast for restaurateurs, ServiceTitan for field service businesses, etc.2

But all earn 25% to 50%+ of revenue from financial services—everything from payments and lending, to payroll, spend management, and more. The revenue share is even higher for newer PEFS that are more deliberate about their financial product strategy. Let’s discuss some of the ways they’ve refined their product strategies.

PEFS target well-defined customer segments or needs, rather than serving a wide range of customers. They don’t try to be everything to everyone; they instead try to be everything to one type of customer. Contrast the generic, impersonal experience a lawyer, restaurateur, and plumber will get from a Chase branch with the highly customized, trusted experience they will get from a Clio, Toast, and ServiceTitan, respectively.

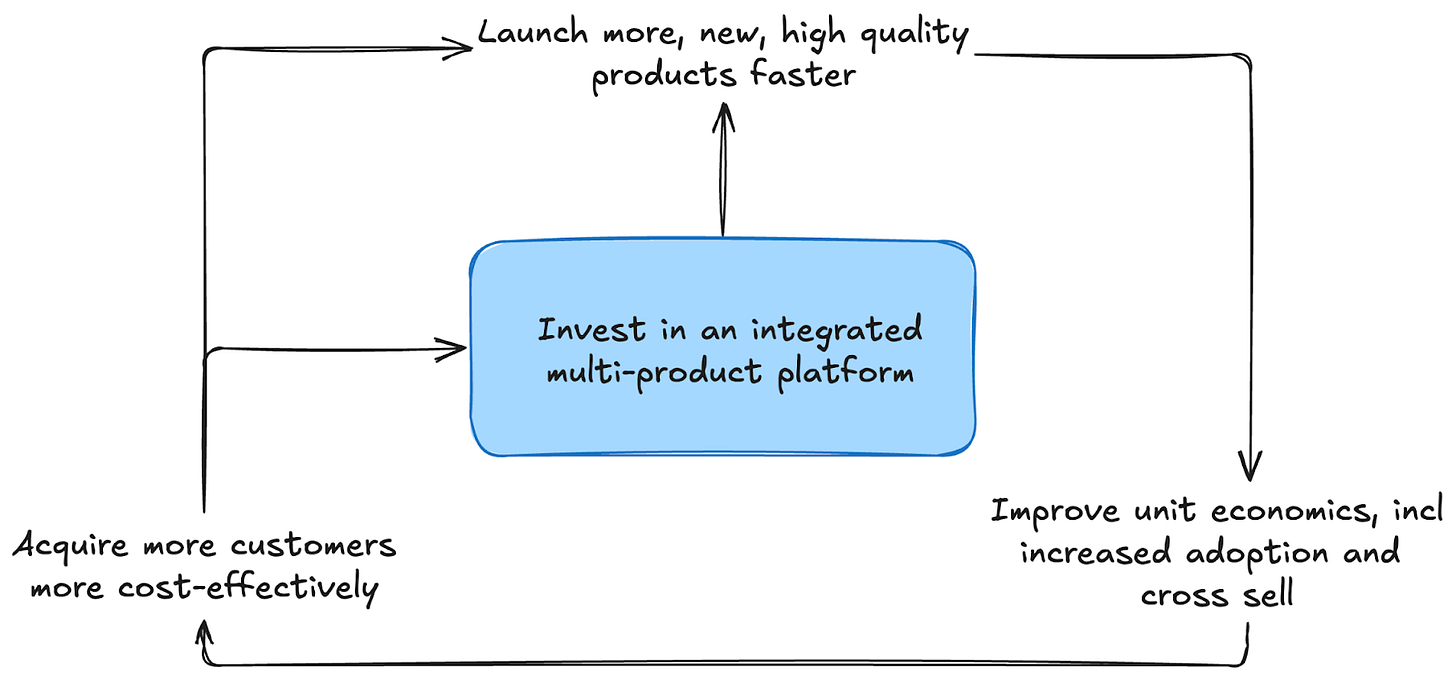

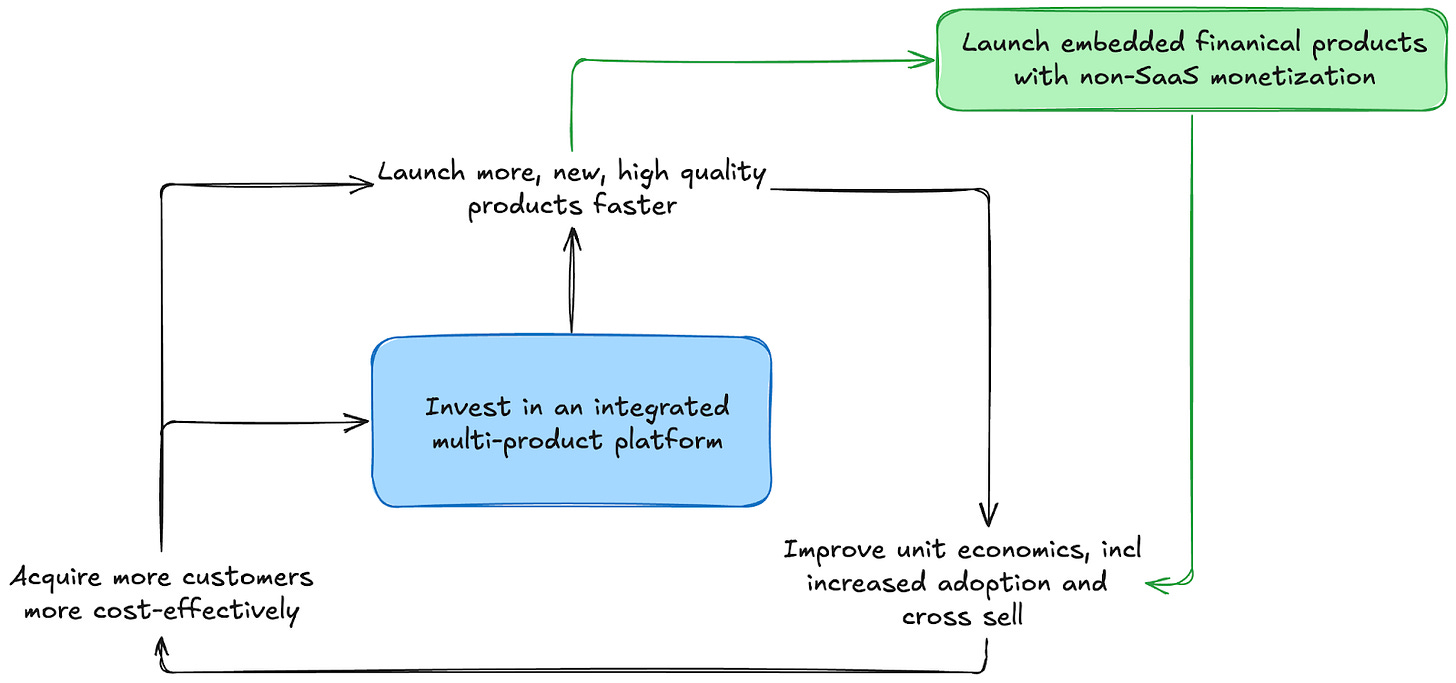

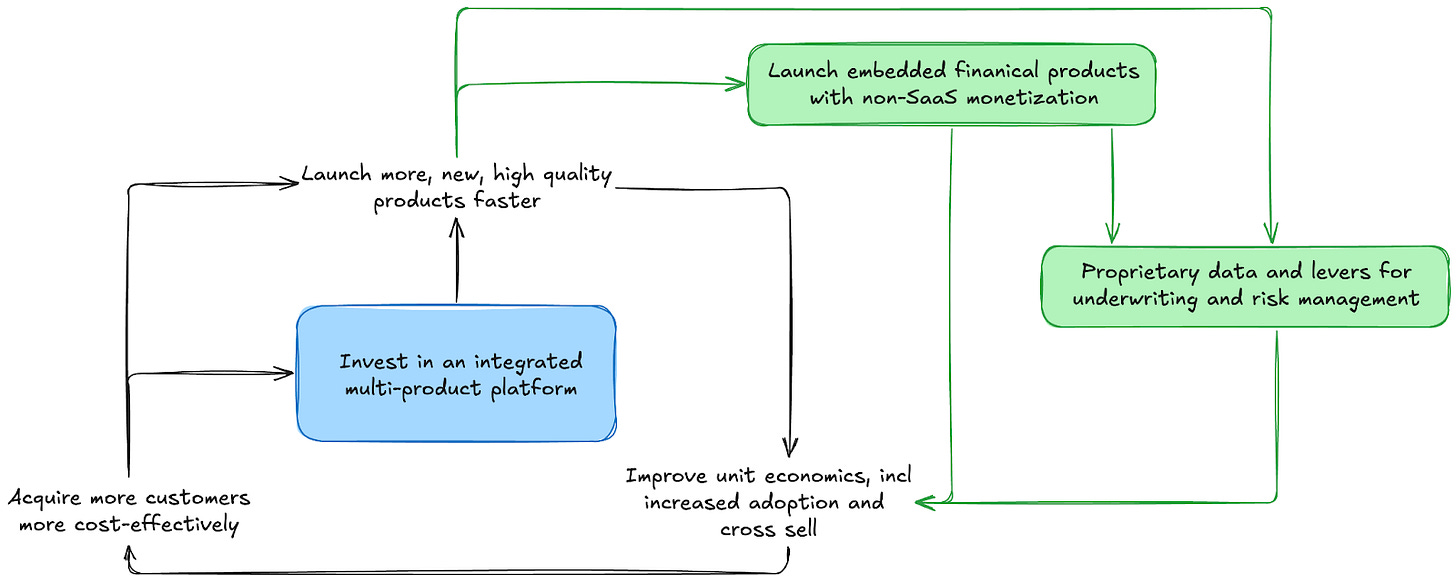

Targeting a specific audience enables PEFS to solve—and monetize—multiple problems for that one audience. Call this focus on being everything to one type of customer a maximalist product approach. The maximalist approach is best described by Parker Conrad's Compound Startup strategy, which leverages a single platform and shared infrastructure to launch a compelling bundle of products quickly to increase LTV and retention.

The maximalist approach and the compound strategy both extend to financial products, which PEFS treat as strategic priorities rather than afterthoughts. The compound strategy naturally complements many B2B workflows (see “B2B payments aren’t payments, they’re workflows”). Financial products have the added benefit of transactional business models rather than SaaS, which lowers the platform’s nominal usage cost for customers.

These financial products are deeply integrated from the start, so they create a unique flywheel that increases adoption and reduces risk. Beyond the benefits of zero CAC and high cross-sell rates, risk is an underappreciated benefit of embedded fintech. Most financial products require some risk assessment and underwriting. This is much easier when underwriting a specific type of user and business, and when you have a broader, longitudinal view of their activity via software.3

The critical role of embedded fintech vendors

PEFS play a critical role in acquiring users and customizing both financial and non-financial products for their specific customers. But financial products come with onerous regulatory, compliance, risk, and capital requirements. Those requirements are why PEFS rely on a rising number of embedded fintech vendors (EFV) to embed and monetize financial products. Examples include Rainforest for payments and Unit for banking.

EFVs serve as a critical abstraction layer between software platforms and financial infrastructure providers like sponsor banks, card issuers, and lenders. Those providers don’t have the technical chops or embedded expertise to support fast-moving software platforms, and the individual platforms are unlikely to have the scale or expertise to work directly with a financial infra provider.4

EFVs meet the challenge of making financial infrastructure easy to embed, customize, and use across diverse platforms and use cases. Their success depends on mastering both the financial primitives they're built on and the unique requirements of each vertical market they serve. Most importantly, they need to deliver an exceptional experience both for the developers who integrate their solutions and for the end users who interact with them.

EFVs have made the wide array of financial products and services that banks offer embeddable within software platforms. Major categories like payments and lending have existed for a while, with companies like Stripe and Fundbox, but modern challengers like Rainforest, Unit, and Pipe have extended and accelerated adoption. Now nearly every product category has an embedded option:

Although EFV is a broad and fast-moving model, there are a few noticeable trends. EFVs are supporting a broader sliding scale of integration options, from fully built-out white-label components to raw APIs and platform ownership of critical functions like risk and underwriting.

Many PEFS are launching multiple embedded products and want the ability to pick and choose the best vendors for different functions like payments and lending. This development is leading EFVs to be more composable and interoperable—witness the integration of Rainforest with Unit. Many scaled EFVs are themselves going multi-product in an attempt to capture multiple financial use cases.

Finally, many EFVs are taking a cue from the platforms they serve and providing tools that complement their financial primitives. Think, for instance, of a card issuer providing embedded spend-management tools. Embedded tools like these offer higher margins and increase adoption.

Embedded fintech is so powerful because it changes the way consumers and businesses access financial services. It reflects the broader trend of offering more convenient, customized, and contextually relevant products and experiences enabled by software and the internet. Giants like Stripe and Toast have shown the power of embedded fintech. But we're only at the end of the beginning. New waves of natively embedded companies, particularly in vertical software, are building even larger and more ambitious companies with the model.

My name is Matt Brown. I’m a partner at Matrix, where I invest in and help early-stage fintech and vertical software startups. Matrix is an early-stage VC that leads pre-seed to Series As from an $800M fund across AI, developer tools and infra, fintech, B2B software, healthcare, and more. If you're building something interesting in fintech or vertical software, I'd love to chat: mb@matrix.vc

This isn’t just a B2B strategy. For example, Uber offers a range of curated, customized, and complementary products to drivers, from a card with high cash back on gas and EV charging, car rentals and sales, and even bundled insurance.

This is a critical topic that we don’t have enough space to cover here, but if you’re interested in learning more, check out “The best companies turn risk into leverage” and “Price and shape risk that others can’t or won't".

For more on embedded payments in particular, check out “Payfac in 1,000 words”.